Discover how Schwab.com can help simplify your financial life.

Learn how to put the intuitive and customizable tools, features, and capabilities of Schwab.com to work for you.

Check out some of our most popular tools and features.

Spotlight

Portfolio check-up

Keep an eye on your investments with real-time updates, data, and information. Compare your current asset allocation to your target allocation or to benchmarks, and make sure your allocation is tracking to your risk tolerance. See the tutorial

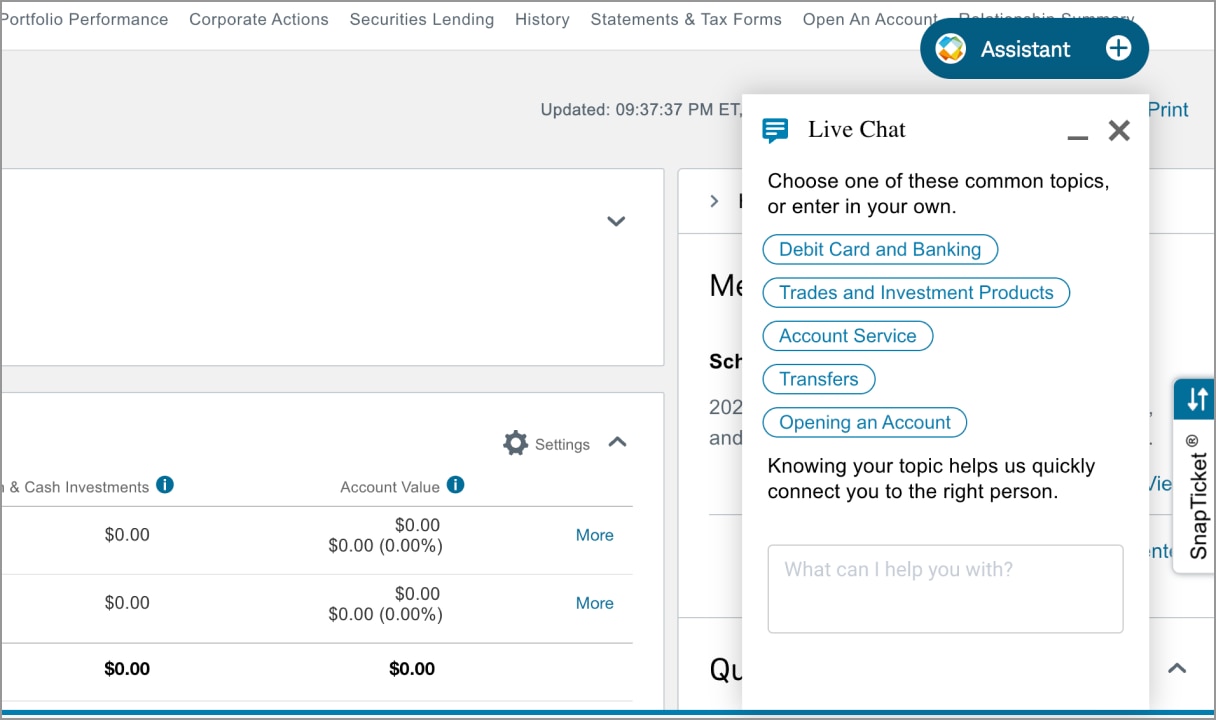

Live chat

Easily connect with a Schwab representative for answers to your questions. To begin, click "Support" in the navigation bar, choose "Chat," then type "Chat with a representative."

Trade

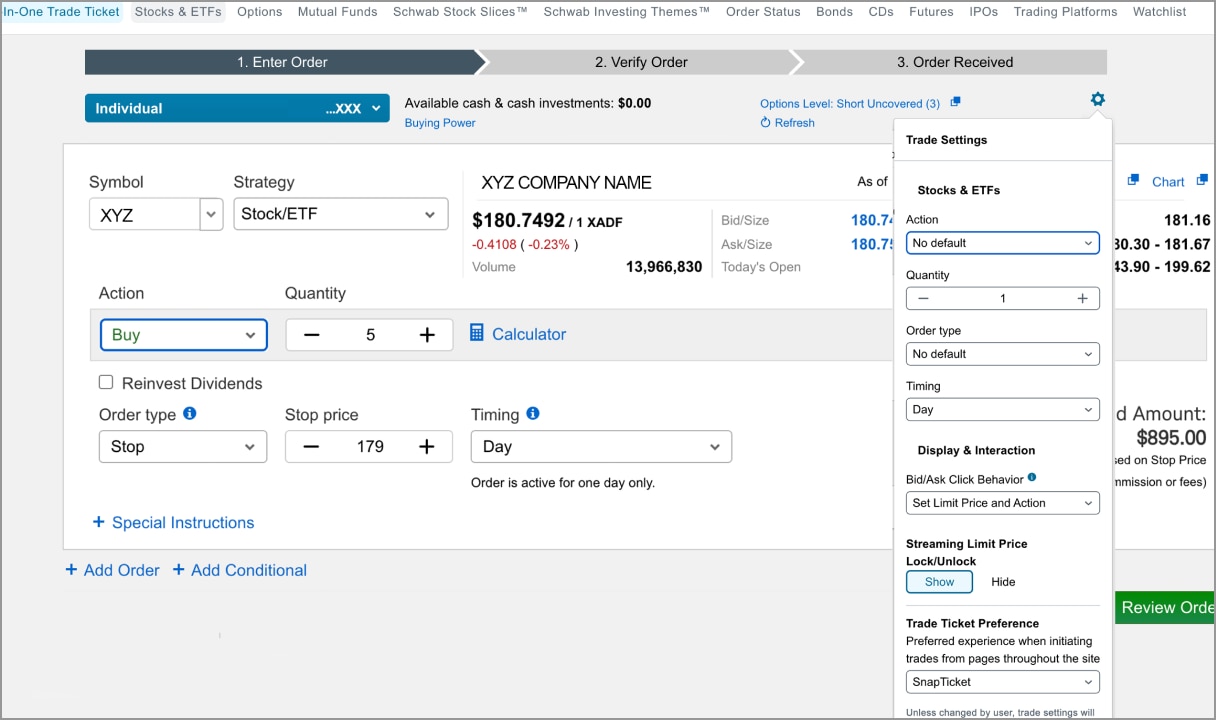

All-In-One Trade Ticket

Our All-In-One Trade Ticket provides easy access to multiple asset types (stocks, exchange-traded funds (ETFs), mutual funds, and options), and lets you place your trades from a single location. See the tutorial

Designed to make trading intuitive, the trade ticket:

- Populates relevant data as you build your order.

- Allows you to trade a range of securities (stocks, options, ETFs, mutual funds, and more), including up to eight stock or ETF orders at once.

- Includes extended hours to order timing choices.

- Can stream the limit price to help create marketable limit orders.

- Integrates the options chain within the options trade ticket.

SnapTicket

SnapTicket is a new, streamlined trade ticket on Schwab.com that allows you to enter orders directly from key pages in your trading workflow.

Access SnapTicket with a single click on the right side of the following Schwab.com pages: Order status, Research, Client summary, Watchlist, Positions, Balances, Options chain, and Transaction history.

Order status

The Order status page on Schwab.com includes a range of customizable features to give you more control over what you want to view. See the tutorial

- Expand or collapse orders to view details that include cost basis, dividend reinvestment instructions, multi-leg options, and more.

- Filter and sort your orders by Status, Security Type, Activity Date, and more.

- Use the "Remember" function to save your filter and sort preferences.

Schwab Investing Themes

Invest in ideas you believe in—including Artificial Intelligence, Cyber Security, and Big Data—with data-driven research and a trading platform that helps you discover and invest in unique opportunities. Our research and proprietary technology does the heavy lifting to uncover new opportunities and identify companies that fit each theme.

Here's how it works:

- Search our catalog of themes.

- View theme performance and stocks within each theme.

- Buy as is or customize by adding or removing companies and adjusting weights with our intuitive platform.

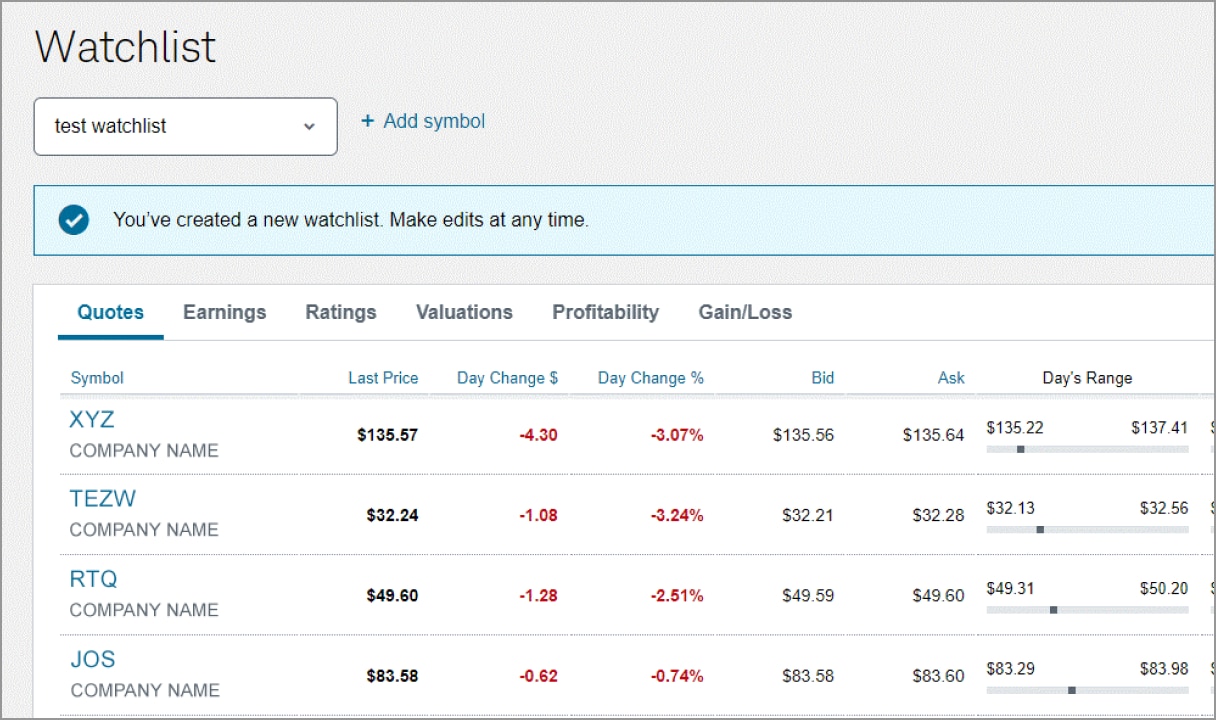

Watchlists

Create multiple custom watchlists to help you keep a close eye on important details and real-time market data for the securities in your portfolio or ones you are targeting. See the tutorial

- Save up to 50 watchlists with up to 300 symbols per watchlist.

- Customize your default watchlist view to prioritize the information you want to see immediately.

Invest

Personalized Portfolio Builder

Use our Personalized Portfolio Builder to create a portfolio that consists of mutual funds or ETFs in just a few steps. This tool may be ideal for investors without the time or interest to focus on portfolio building. See the tutorial

How it works:

- Determine your fund preference, risk profile, and initial investment.

- The tool will then generate suggestions for several categories of funds, including U.S. Large Cap, Small Cap, International, and Fixed Income.

- You can customize the allocations as you want and buy the selected funds all at once for your own fund portfolio.

Investment Income Summary

Get a convenient view of your received and estimated dividends and investment income. See the tutorial

Portfolio Performance

Portfolio Performance helps you review what your account or portfolio has gained and lost over time to see how your money is working for you.

We show two views of performance: value vs. net contributions and rate of return. The difference between value and net contributions is a good indicator of the market’s role in your gains and losses. You can also compare your performance to indexes to see how you stack up against different market segments.

Personalized Indexing dashboard

Use your personal dashboard to easily view account details and monitor performance compared to the benchmark index. See the tutorial

- You'll find the "Account value" module, which displays the net value of your account, including stocks and cash, dividends, deposits, withdrawals, and fees.

- View "Sector weighting" for a breakdown of the account value by exposure.

- "Hypothetical after-tax performance" lets you view the performance of your account compared to the account's benchmark index, net of taxes, and fees.

Fund Finder tool

Discover mutual funds or ETFs that match your preferences within several criteria including category, ratings, and transaction fees. Select up to five of your search results to compare in a side-by-side chart. See the tutorial

Research

Screeners & tools

Intuitive and powerful digital tools help you quickly filter and find investment candidates that meet your criteria, including:

- Screeners, comparison tools, and research-backed lists for stocks, ETFs, and mutual funds

- The Fixed Income Screener Find for identifying bonds, new issues, CDs, or bond ETFs that meet your criteria.

- Interactive calendars to view economic events, earnings and dividend announcements, splits, and more.

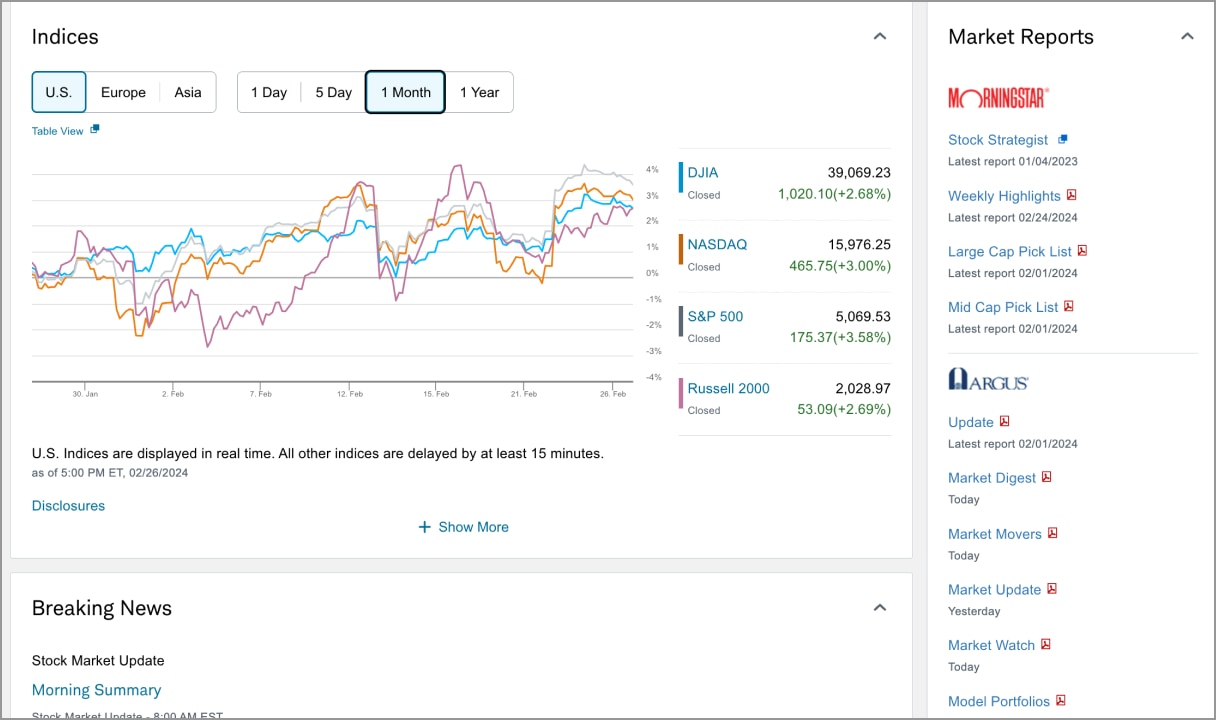

Third-party reports

Access premium, independent research reports from Morningstar® and Argus for a balanced perspective on what's going on in the markets.

You can also view in-depth analysis on individual securities, including buy/hold/sell recommendations from MSCI, LSEG Data & Analytics, MarketEdge, CFRA, and Vickers.

News

Quickly scan breaking market news with the top headlines of the day from leading providers, such as Reuters and Briefing.com. Filter the news to see only the sources you want, or search the news by keyword or symbol.

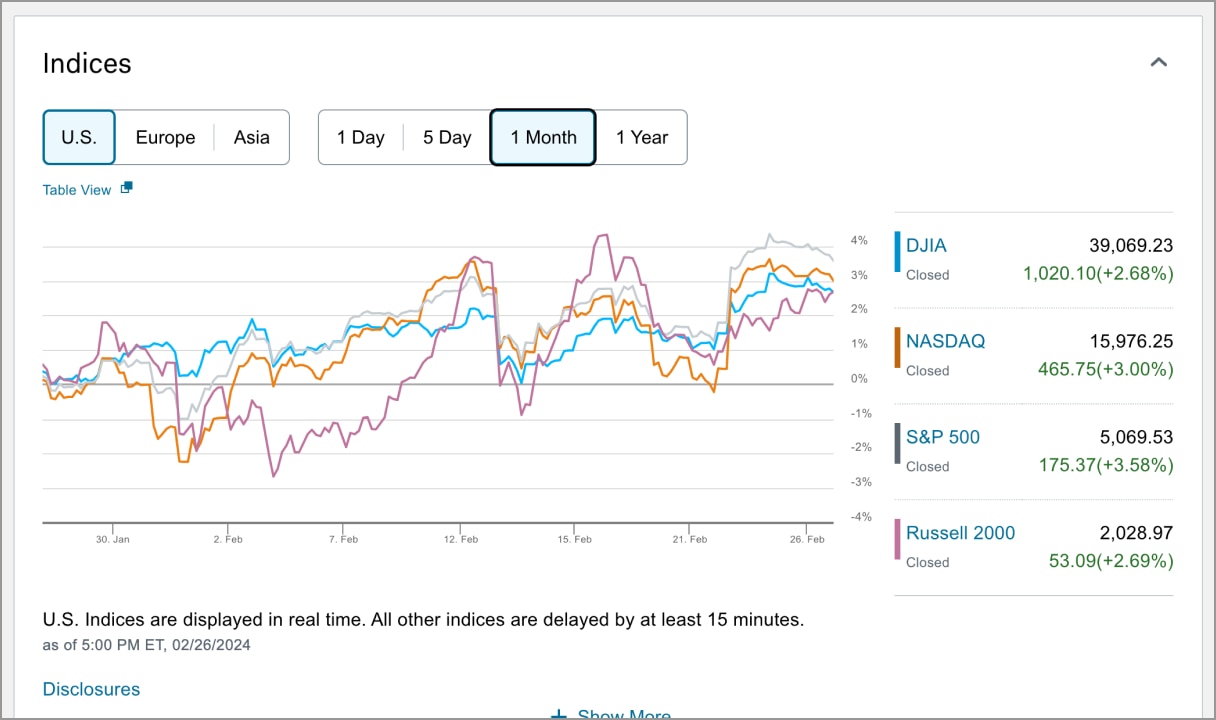

Markets & indices

View performance of major markets and indices around the globe, with the ability to customize your time frame to identify trends you're interested in.

Move Money

Funds transfers

If you want to transfer funds from a Schwab account, you have several routes to choose from: online transfer, wire transfer, or requesting a check. See the tutorial

- Online transfers take one to two business days to complete and do not involve fees. You just need to enter the amount, frequency, and transfer date.

- Domestic wire transfers arrive the same business day for online wire requests. You'll need the destination bank routing number, account number, recipient account holder name, and recipient address.

- Checks take six to nine business days to arrive with no fees unless you want it sent overnight.

Positions transfers

You can transfer positions between your Schwab brokerage accounts online quickly and easily.

From the Online Transfer page, select the accounts, and then choose the share amount for each security you would like to transfer. Please be aware that some positions, like short positions, are not available to transfer. See the tutorial

Bank

BillPay

Browse the list of company categories or search directly for the biller you're looking for. If you search for a biller that does not exist in our network, you will be prompted to manually add them. Choose the biller you would like to pay and enter the requested billing information. You'll receive a confirmation message once your payment process is complete. See the tutorial

Card alerts

For each account and issued debit card, you have several alert options to choose from. You can select how you would like to receive alerts as well as the type of activity you would like to be alerted for.

To get started, log in, click "Support," and select "Debit Cards & Checks." Then select "Debit Card Alerts."

Card lock/unlock

If you've misplaced your Schwab Bank Visa® Platinum debit card, you don't have to immediately cancel your card. Instead, you can simply lock your card as you continue to search for it—a process that takes just minutes from your phone.

However, if you think your card was stolen, you should call Schwab Bank immediately at 1-888-403-9000.

Learn

Insights & Education

Stay on top of the ever-evolving financial landscape with timely market insights and educational resources tailored to empower you on your financial journey. Learn the way you want with curated experiences including articles by trading experts, videos, podcasts, interactive courses and more.

Courses

Our comprehensive online courses guide investors through the basic and more advanced elements of important financial concepts, including retirement portfolio management, trading with technical analysis, income investing, and more. Courses include quizzes, wrap-ups, and additional resources.

Learning paths

Review collections of articles, videos, and more covering in-depth topics.

Schwab Coaching

Schwab Coaching allows you to learn from trading professionals in a live, interactive setting.

- Observe trading professionals "over the shoulder" as they demonstrate trading concepts and strategies.

- See how trading principles are applied in current market conditions for deeper, more practical learning.

- Learn how to execute concepts and strategies using thinkorswim® and other Schwab platforms.

- Use the live chat feature during webcasts to engage with hosts in real time—ask questions, get answers, and be part of the discussion.

Account management

Schwab Assistant

Schwab Assistant is a virtual agent that can answer questions, provide general information, help you navigate the site, and more. See the tutorial

You can also use it to chat with a live representative. To begin, click "Support" in the navigation bar, choose "Chat," then type "Chat with a representative."

Adding trusted contacts and beneficiaries

You can easily add a person that Schwab would contact if we are unable to communicate with you regarding issues related to your account. You can also edit or manage the beneficiaries on each of your accounts. See the tutorial

Account access

Authorize limited or full trading authority (LTA or FTA) to a third party to act on your behalf in connection with your account. LTA provides view-only access to account information and the ability to trade, while FTA provides the same plus the ability to move money. See the tutorial

Manage trusted devices

A trusted device is a device you use frequently, such as your personal cell phone, tablet, or home computer. See the tutorial

- You can quickly and easily add, review, or remove trusted devices from your profile.

- You can review a list of all devices that have completed the 2-step verification process for your account.

- You can give a custom name to a device to help you quickly recognize it in case you use multiple devices.

Securities alerts

You can set up alerts to track the activity of individual securities covering a range of criteria, including:

- Price

- Volume

- Earnings

- Dividend

- News

- Research reports

You can choose the delivery method of the alert - by email or by wireless text message. See the tutorial

Common questions

Transferring your account to Schwab is easy. No long forms or high fees and we offer 24/7 help when you need it. When you open an account with Schwab, select "investment account transfer" as your funding option. Your account will be approved and ready to fund within five business days. Then you will be able to log in and follow these easy steps in our Transfers and Payments section. See the tutorial

You can open a Schwab account in just 10 minutes, and Schwab offers accounts for brokerage, IRA, banking and more. If you're interested in opening an account, click here to see all account options.

To help protect your personal information from being lost in the mail, enroll today to receive your documents electronically. See the tutorial