Manage your own investments with ease.

Take control of your investing with a full range of tools, resources, and support.

What is self-directed investing?

Self-directed investing involves managing and making investment decisions on your own. You have full control over your portfolio, along with the freedom to choose the best investment strategies for your financial goals and risk tolerance.

Trade easily and confidently.

Anywhere trading.

Place trades on Schwab.com, with our mobile app,1 or using the thinkorswim® suite (desktop, web, and mobile).

Helpful trading features.

Manage investments with our watchlists, alerts, and All-In-One Trade Ticket®.

Choice of investments.

Access and trade a wide range of investment products like stocks, exchange-traded funds (ETFs), mutual funds, and options.

Use helpful guides and tools to choose what to invest in.

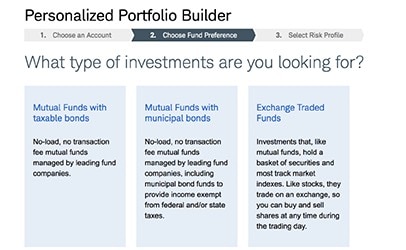

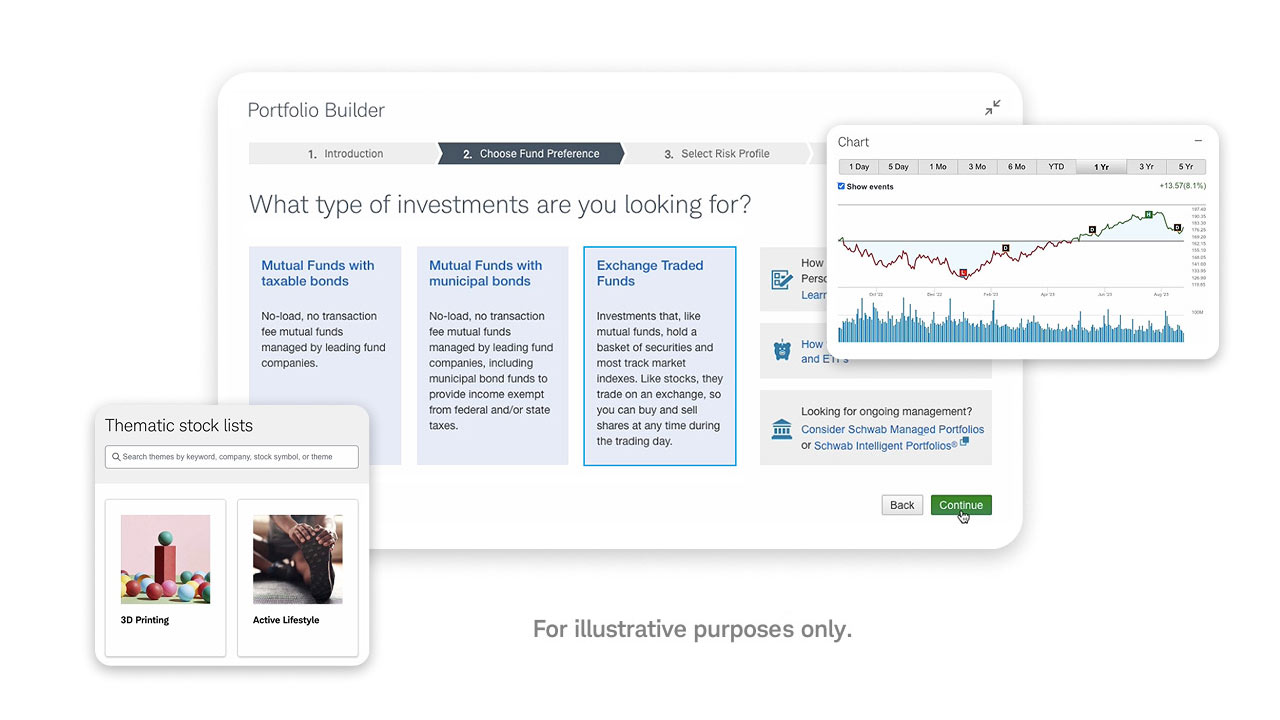

Choose what to invest in with help from our free Personalized Portfolio Builder tool.

- Determine your fund preference, risk profile, and initial investment.

- Choose from ETFs or mutual funds.

- No minimum investment required.

For illustrative purposes only.

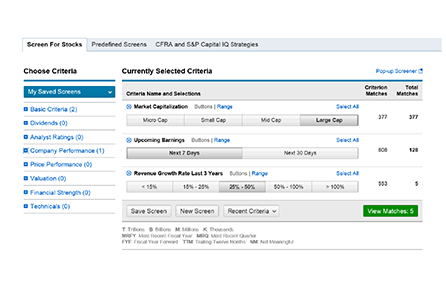

- Find stocks, mutual funds, or ETFs using over 100 criteria with our research screeners.

- Get clear A-B-C-D-F equity rating2 grades on how a stock might perform compared to the equities market over the next 12 months.

- Access premium independent research and analysis from Morningstar®, Argus Research, and several other providers.

For illustrative purposes only.

- Use our Schwab Investing Themes®3 as an approach to help you invest in new trends and opportunities.

- Already a client? Use our Fund Finder tool to easily select mutual funds that align to your goals.

For illustrative purposes only.

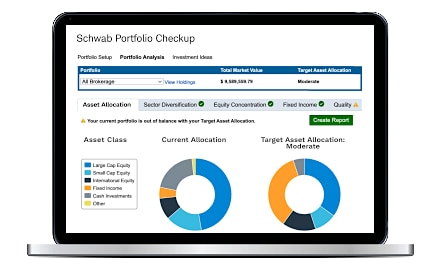

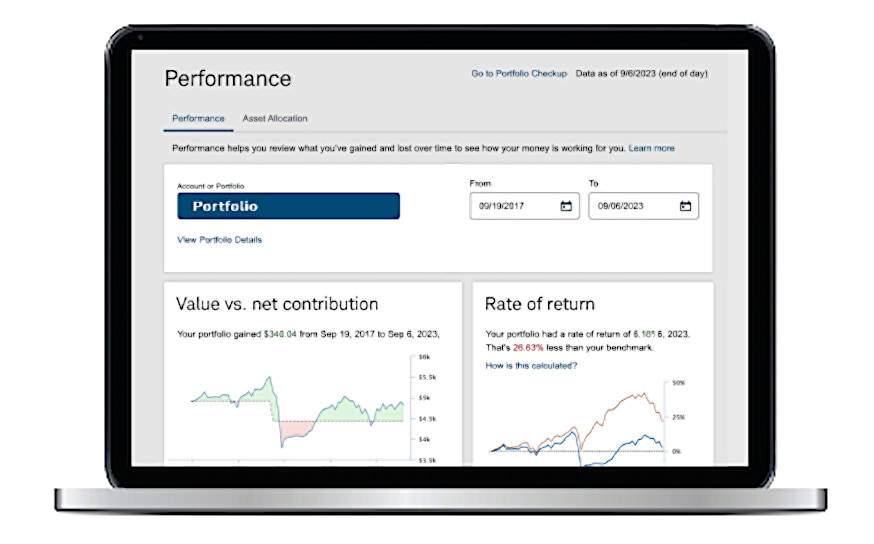

Track and evaluate your performance to plan your next move.

Get in-depth education and timely expert perspectives.

Enjoy best-in-class education combined with Schwab experts' timely market commentary and perspectives on investing, trading, and personal finance. We have courses, articles, videos, webcasts, and podcasts to help you invest and manage confidently.

Explore our latest market commentary and discover in-depth education, including workshops and courses on investing and trading.

For illustrative purposes only.

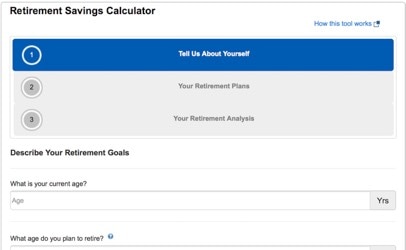

Get started.

Ready to invest on your own? Follow these five simple steps.

Open a self-directed brokerage or IRA account today.

Take the first step toward building your portfolio with Schwab. With no account minimum.

Fund your account.

Once you link your bank account, you can start transferring funds to your Schwab account.

Use Schwab research and tools.

Our experts break down market news to provide practical insights and ideas you can use.

Choose your investments.

Need help choosing? Try our free Personalized Portfolio Builder tool.

Monitor and manage your portfolio.

Track and evaluate your performance to plan your next move.

Common questions about self-directed investing.

Self-directed investing means that the account holder(s) chooses their own investments, how much to invest, as well as when to buy and sell them.

That's a question of personal preference. In our experience, self-directed investing is best for people who enjoy taking charge of their finances, researching investments, and making their own decisions, especially with a long-term, buy-and-hold mindset.

We also find that many Schwab clients like to mix and match, with some accounts that are self-directed and some accounts that are professionally advised.

And remember: Self-directed investing doesn't mean you're completely on your own. If you choose to self-direct at Schwab, you can access perspectives from the Schwab Center for Financial Research, Schwab Financial Consultants, and our knowledgeable specialists to inform and help guide you—but ultimately, you still get to make all the calls.

Many of Schwab's most popular accounts can be self-directed, including individual and joint brokerage accounts as well as Roth and traditional Individual Retirement Accounts (IRAs). Clients can also self-direct 529 College Savings Plan accounts, education savings accounts, custodial accounts, trust accounts, and certain small business retirement accounts—including individual 401(k)s, SEP IRAs, and Simple IRAs. Some employer-sponsored 401(k) plans allow participants to open a Schwab Personal Choice Retirement Account® to gain more control over their retirement investments.

Absolutely! Roth and traditional IRAs are some of our most popular self-directed accounts. In addition, Schwab supports self-directed investing on rollover, inherited, and custodial IRAs. Many small business retirement accounts (individual 401(k)s, SEP IRAs, and Simple IRAs) can also be self-directed.