Trading micro futures contracts

Whether you're just getting started or want to access futures markets at a smaller scale, micro futures can provide a lower cost of entry and lower margin requirements, which could be an efficient way to diversify your portfolio.

Futures and futures options trading is provided by Charles Schwab Futures and Forex LLC.

What are micro futures?

A micro futures contract is a smaller version of the same futures contract. This means they require significantly less capital to trade—which can help you hedge or speculate on the stock market and commodities at a lower initial cost. Keep in mind that leverage can create the potential to lose more than your initial investment with smaller market movements.

Micro Crude Oil futures

Futures-approved traders have the opportunity to get precise exposure to the oil market. Micro Crude Oil futures are 1/10 the size of the standard crude oil futures contract with smaller requirements.

Discover how Micro Crude Oil futures contracts can provide a cost-efficient way to trade one of the most actively traded commodities by reading "Micro Crude Futures Offer Lower-Cost Oil Trading" and learn about their risks.

Micro crypto futures

Micro Bitcoin futures (MBT), Micro Ether futures (MET), Micro Solana futures (MSL), and Micro Ripple futures (MXP) may provide an efficient, cost-effective way to fine-tune crypto exposure and enhance your trading strategies at a fraction of the size of a standard contract.

What are futures options?

Futures options are contracts that give you the right, but not the obligation, to buy or sell a futures contract at a set price before a certain date.

With futures options, you can place option trades on a variety of micro futures markets, including metals, agriculture, and more. Depending on your outlook and goals, you can pursue directional trades, market-neutral strategies, or hedge existing positions.

They may also offer a way to manage risk or diversify with smaller initial capital. Just remember, smaller initial capital can still result in substantial losses, potentially exceeding the initial investment. Overall, futures options involve complex risks and are not suitable for all investors.

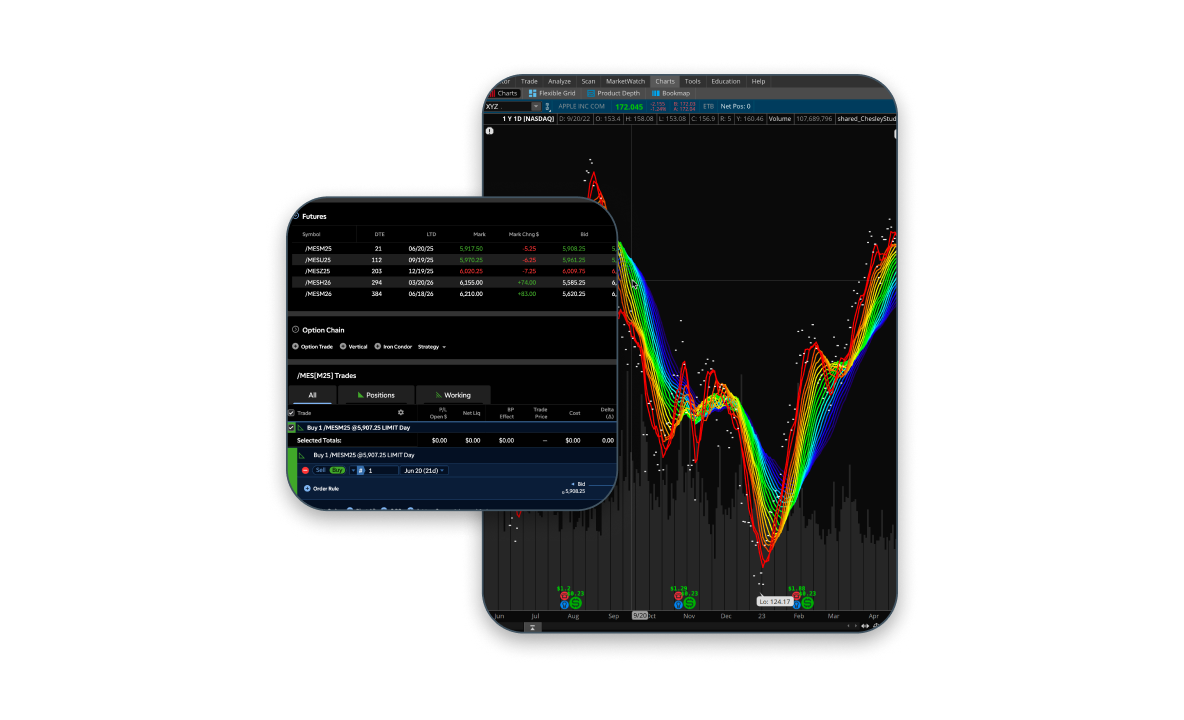

Supercharge your futures trading.

Discover a trading experience you can't get anywhere else, featuring the award-winning thinkorswim platforms, tailored education, and specialized support.

Micro Futures FAQs

Many micro futures trade nearly 24 hours a day, starting Sunday evening and ending Friday afternoon, with short breaks each day. Please reference the micro futures table above for specific product information.

Micro futures make it more accessible to gain exposure to major markets with lower initial costs and smaller contract sizes. They can be a useful way to build experience or fine-tune a strategy. That said, all futures involve leverage, so even a small move in the wrong direction can result in a significant loss, which may be potentially more than your initial investment. It's important to have a clear plan and risk controls when considering trading futures.

Ready to trade futures?

Not yet a Schwab client?

Open a brokerage account online, then go to the Getting Started page for next steps.

Already a client?

Use your eligible brokerage account to apply for a futures trading account.