Understanding futures margin

Futures and futures options trading is provided by Charles Schwab Futures and Forex LLC.

What is futures margin?

Margin is the amount of funds required to enter a futures position—typically a fraction of the total value of the contract. Any product traded on margin means it's leveraged, exposing you to a larger asset position.

Get more details and an example of how futures margin works with "How Futures Margin Works."

A few futures margin basics

Margin

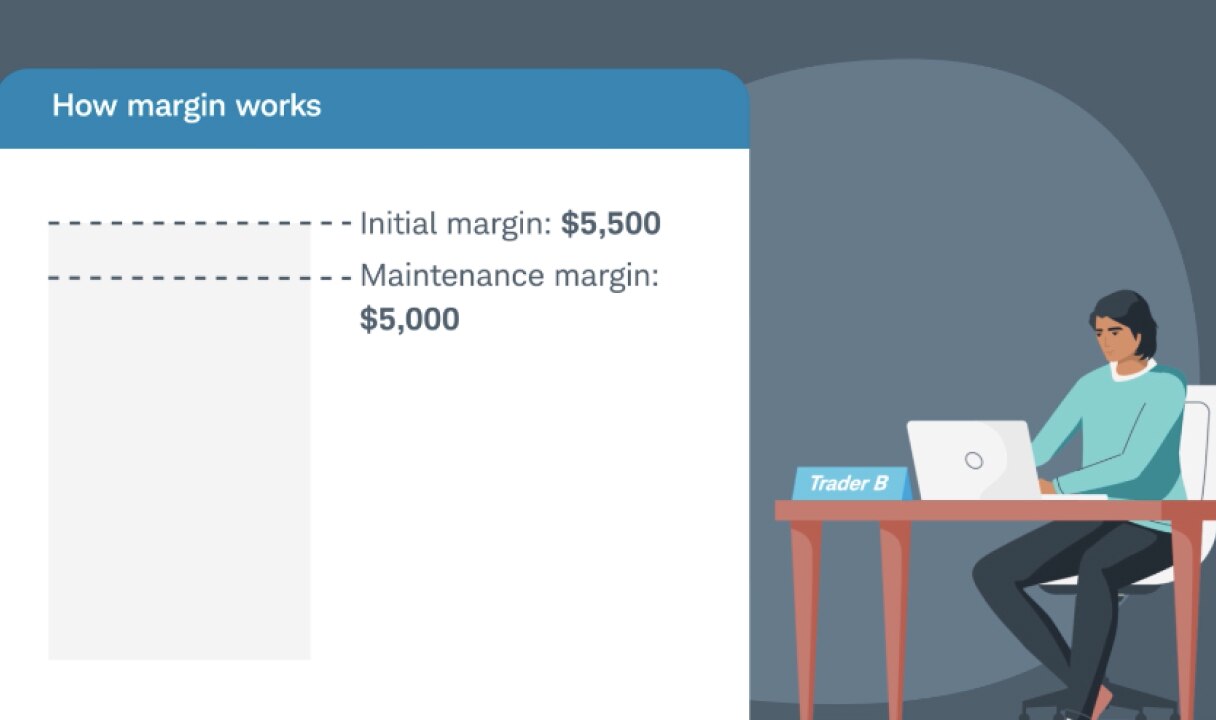

In stocks, you can borrow against your assets like a loan. In futures, you put down a good faith deposit called the initial margin requirement. The cash for the initial margin requirement is automatically set aside in your account and subtracted from your buying power once an order is entered.

Margin requirements

Whether you go long or short, initial margin requirements vary by futures product, generally ranging anywhere from 3% to 12% of the notional value of the contract. There's also a maintenance margin requirement (balance your account must carry to stay in a position) that may be increased at any time.1

Leverage

As leveraged investments, a relatively small amount of initial capital exposes you to a larger futures contract amount. While this leverage can provide an efficient use of capital, it can potentially amplify losses beyond the amount originally invested.

Futures margin in thinkorswim®

Schwab's thinkorswim trading platforms are designed to help make it easy to identify and manage your margin requirements when viewing futures symbol data.

Ready to trade futures?

Not yet a Schwab client?

Open a brokerage account online, then go to the Getting Started page for next steps.

Already a client?

Use your eligible brokerage account to apply for a futures trading account.