Futures contract details

Explore the components of futures contracts along with some basic futures concepts.

Futures and futures options trading is provided by Charles Schwab Futures and Forex LLC.

Each futures contract has different specifications, including these:

Contract size

A futures contract has a standardized size that does not change, but it can be different for each product.

For example, one contract of crude oil (/CL) represents 1,000 barrels. And one contract of gold futures (/GC) represents 100 troy ounces. However, the E-mini S&P 500 futures (/ES) represent $50 times the price of the S&P 500 Index, while the Micro E-mini S&P futures (/MES) represent $5 times the price of the S&P 500.

Contract value

Also known as a contract's notional value, contract value is calculated by multiplying the size of the contract by the current price.

For example, the E-mini S&P 500 contract is $50 times the price of the index. If the index is trading at 2,250, the value of one E-mini S&P 500 contract would be $112,500.

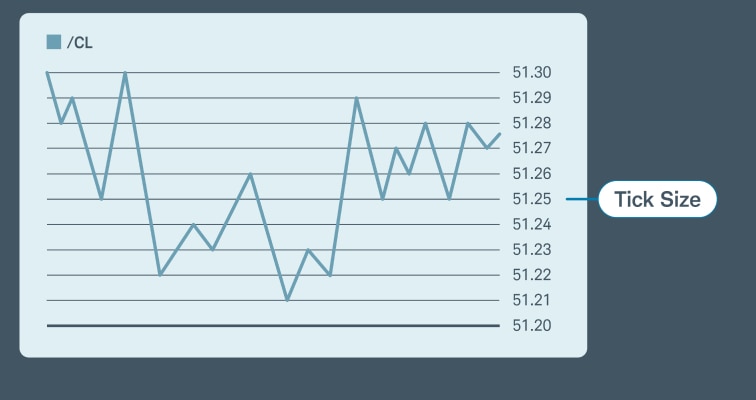

Tick size

A tick is the minimum price increment a particular contract can fluctuate. Tick sizes and values vary from contract to contract.

For example, a tick in /ES is 0.25 per point. Since /ES represents $50 times the S&P 500 Index, every 0.25 move in /ES equals $12.50.

Trading hours

Most futures markets are open nearly 24 hours per day, from Sunday evening until Friday afternoon, but some futures products have unique trading hours.

For example, you can trade E-mini S&P 500 futures between 6:00 p.m. ET and 5:00 p.m. ET, while corn futures can be traded from 8:00 p.m. ET through 2:20 p.m. ET with a 45-minute pause from 8:45 a.m. ET to 9:30 a.m. ET.

Delivery

Futures contracts have expiration dates and are either cash settled or physically settled at expiration.

- Cash settled futures contracts expire directly into cash at expiration. /ES is an example of a financially settled product.

- Physically settled futures contracts expire directly into the physical commodity. /CL is an example of a physically settled product. At expiration, anyone long a contract in /CL will receive 1,000 barrels of crude oil. However, Charles Schwab Futures and Forex LLC doesn't allow clients to take physical delivery of a futures contract, and are cash-settled.

More important futures trading concepts to know

Mark-to-market

At the end of each trading day, your futures account is updated to reflect gains or losses on open positions. This process, called mark-to-market, uses the day's settlement price, which varies by product and is set by the exchange. These updates affect your cash balance and help determine whether you're still meeting margin requirements. Mark-to-market is a core part of how risk is managed in futures trading and important to understand.

Futures roll

Rolling a position means closing out your current contract and opening a new one in the next available month. The new contract will likely have a different price, and each leg of the roll comes with transaction costs. Because Charles Schwab Futures and Forex LLC does not support physical delivery, it's important to monitor key expiration dates, especially Tooltip and Tooltip . Rolling ahead of these deadlines helps you avoid assignments and maintain your market exposure.

Ready to trade futures?

Not yet a Schwab client?

Open a brokerage account online, then go to the Getting Started page for next steps.

Already a client?

Use your eligible brokerage account to apply for a futures trading account.