Wealth management focused on you.

You've worked hard to build your wealth. Now it's time to make it work for you. Schwab Wealth Advisory™ delivers exceptional client service and advice to help you achieve your most important financial goals. Once enrolled, you receive:

A personalized approach to wealth management that starts with your goals and includes key aspects of your financial life.

A wealth management strategy with advice and investment guidance that adapts to life changes.

A dedicated Wealth Advisor backed by an experienced team.

Schwab Wealth Advisory ranks #1 in the wealth management category on IBD's 2025 Most Trusted Financial Companies list

A personalized approach to wealth management.

Schwab Wealth Advisory can help you meet your needs today, tomorrow, and in the years to come. We offer professional wealth management on your terms.

You'll be involved in every step of the planning process, no matter where your financial journey takes you. Your life is unique. Your financial plan should be tailored to match it.

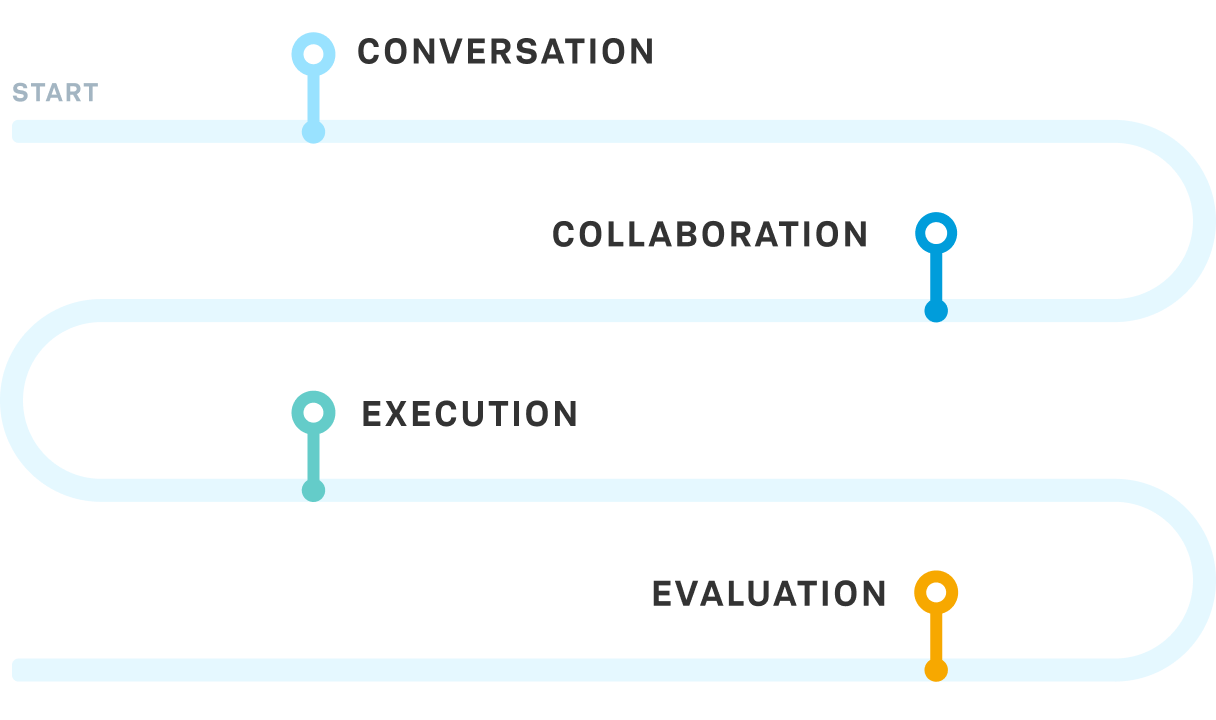

Conversation

By asking questions and listening attentively, your dedicated team can help you focus on what really matters when it comes to building and managing your wealth.

Collaboration

You have the ability to choose how much we're involved. Whether it's building your investment portfolio, creating your retirement plan, or helping you build long-term wealth, we'll work with you to help keep you moving forward.

Execution

We're here to help you put your plan into motion and navigate a broad range of wealth management topics.

Evaluation

As your needs change and evolve, we'll review your financial situation and help you make adjustments to keep you on track.

A plan that adapts to your changing needs.

Your wealth deserves more than a one-size-fits-all planning approach. Enjoy the comfort and confidence of working with a Wealth Advisor who deeply understands you and your financial situation and has experience guiding clients through their own unique financial journeys and life stages.

- Starting out

- Building your career

- Raising a family

- Planning for retirement

- Managing a family office

- Retirement

- Defining your legacy

Discover how Schwab Wealth Advisory can adapt to different financial journeys.

Our three-pillar investment philosophy.

Personalized

We believe your portfolio should reflect your circumstances, goals, risk tolerances, and personal preferences.

Diversified

We believe a diversified portfolio that evolves over time based on your needs and market conditions increases your likelihood of financial success.

Disciplined

We believe rigorous research and selection of investments and opportunities are essential to you achieving your goals and that it's also important to be mindful of cost, taxes, and other factors that impact your portfolio.

Flexibility to invest your way.

Manage your portfolio with tailored advice from your Wealth Advisor, or delegate part or all of your investment decisions to portfolio managers who will manage assets based on your investment objectives.1

We provide the flexibility to invest in stocks, bonds, mutual funds, exchange-traded funds (ETFs), separately managed accounts, alternative investments, and more.3

1. Delegated portfolio management provided by Schwab Asset Management® or third-party money managers.

3. To be eligible for Alternative Investments, certain qualifications must be met including having at least $5M in household assets held at Schwab and having been a Schwab client for at least 30 days.

A team dedicated to your needs.

Your Wealth Advisor and Financial Consultant are by your side to help you make informed decisions about your wealth. Your experienced team draws on Schwab's deep investment management and planning resources, giving you confidence as you pursue your most important financial objectives.

Your Wealth Advisor

Your experienced, credentialed Wealth Advisor gets to know you and your family's financial needs with services including:

- Evaluating your portfolio and providing investment recommendations.

- Identifying and responding to your broader wealth management needs.

- Periodically reviewing your progress and adjusting your strategy to changes in your circumstances per your directions.

- Working with specialists for guidance on topics including risk management, asset protection, hedging strategies, executive compensation, business succession, charitable giving, fixed income, and liquidity needs.

Your Financial Consultant

As a complement to your Wealth Advisor, your Financial Consultant coordinates your entire relationship with Schwab, including:

- Serving as your guide at Schwab to help get you on track to meet your goals.

- Staying connected with your Wealth Advisor as you make informed decisions about your wealth.

See real life-inspired stories of how Schwab Wealth Advisory can support different financial journeys.

Value you can expect from Schwab.

For more than 50 years, Schwab has been there for investors through good times and bad. Our client-first approach means that whatever comes your way today, we will always be invested in your tomorrow.

Satisfaction Guarantee

If for any reason you are not completely satisfied, we'll refund your fees or commissions and work with you to make things right. View details.

Pricing

The annual fee for Schwab Wealth Advisory starts at 0.80% of assets, and the fee rate decreases at higher asset levels (see fees question below for full details). Enrollment minimum is $500,000.

Security Guarantee

Schwab will cover losses in any of your Schwab accounts due to unauthorized activity. View details.

Looking for help? Let's start a conversation.

Tell us about yourself so we can help connect you to the support you need. Just answer a few questions and we'll reach out by email or phone.

Common questions about wealth management services

The annual fee for Schwab Wealth Advisory starts at 0.80% of assets and decreases at higher asset levels (see chart). Enrollment minimum is $500,000. Fees for your enrolled accounts are based on daily asset levels and are applied at the end of each quarter.4

| Billable Assets | Fee Schedule |

|---|---|

| First $1 million | 0.80% |

| Next $1 million (more than $1M up to $2M) | 0.75% |

| Next $3 million (more than over $2M up to $5M) | 0.70% |

| Next $5 million (more than $5M up to $10M) | 0.50% |

| Next $15 million (more than $10M up to $25M) | 0.30% |

| Assets more than $25M | 0.30% (or less, as negotiated) |

At Schwab's discretion, discounts may apply depending on assets and/or other factors. Please refer to Schwab Wealth Advisory Disclosure Brochure for additional details.

4. Portfolio Management provided by Schwab Wealth Advisory, Inc., a Registered Investment Adviser and affiliate of Charles Schwab & Co., Inc. (Schwab). Please read the Schwab Wealth Advisory and the Schwab Wealth Advisory, Inc. Disclosure Brochures for information and disclosures about this program. The Wealth Advisor, Associate Wealth Advisor, and other representatives making investment recommendations in your Schwab Wealth Advisory accounts are employees of Schwab Wealth Advisory, Inc.

Schwab Wealth Advisory, Inc. has more than 800 team members with dedicated wealth experience, and 83% of our Wealth Advisors hold a professional designation in their area of expertise (as of July 2025). Once enrolled, you will receive regulatory documents that detail your advisor's background and associated professional designations and certifications.

Yes. Your wealth management team will help you navigate life's key financial decisions—from retirement planning to tax-smart investing to estate planning. We deeply understand the financial needs of ultra-high net worth individuals and are equipped to support complex wealth scenarios, including private wealth management and multigenerational planning.

Yes. You and your dedicated team will engage in discovery conversations related to your specific financial situation. Your portfolio is tailored to your needs and goals and may include tax planning and investment planning.2

2. Certain services may be provided by affiliated professionals and third-party firms. Schwab does not provide specific individualized legal, regulatory, tax or compliance advice. Consult professionals in these fields to address your specific circumstances.

No, you have access to both. Your Financial Consultant matches you with your Wealth Advisor and coordinates your entire relationship at Schwab, assisting you with big-picture needs and helping make sure you get the best of what Schwab has to offer.

Your Wealth Advisor is your contact for all Schwab Wealth Advisory-specific matters and will help manage your portfolio and wealth management needs.

Your Financial Consultant coordinates your entire relationship with Schwab and can help connect you with specialists and service support. Your Wealth Advisor is your primary contact for inquiries related to your Schwab Wealth Advisory client relationship, wealth management strategy, and portfolio management.

Your Wealth Advisor doesn't provide specific tax advice. However, they can work with you to target tax-smart investment and planning strategies.2

2. Certain services may be provided by affiliated professionals and third-party firms. Schwab does not provide specific individualized legal, regulatory, tax or compliance advice. Consult professionals in these fields to address your specific circumstances.

After logging in to Schwab.com, go to the Accounts tab, then to History and Statements, and finally to Statements and Reports.

Review of your portfolio is managed on an as-needed basis with your Wealth Advisor and continues as long as you are enrolled in the Schwab Wealth Advisory program. The frequency of portfolio reviews is agreed upon between you and your dedicated advisor.

If your financial plan needs to evolve—whether you're starting a business, changing careers, or moving—your financial advisor will help you realign your strategy. You will first work with your Wealth Advisor to amend your financial plan. With your approval, your advisor will adjust your portfolio to align with your revised plan. You and your advisor may also consult with Schwab specialists to address specific wealth planning or management needs.

We believe in the long-term benefits of relying on our traditional disciplines around asset allocation and diversification, including tuning out the noise to the extent possible and sticking to your long-term goals and investment objectives. That said, if at any time you have concerns, you can contact your Wealth Advisor for guidance.

You and your Wealth Advisor will work together to determine how often you both review your strategy, plan, and portfolio performance.

Only clients enrolled in Schwab Wealth Advisory are matched with a dedicated advisor.

You can choose to approve each investment purchase or sale prior to trade execution or delegate part or all of your investment decisions to Schwab Asset Management® or third-party money managers who will manage portions of your portfolio for you based on your investment objectives.