Combine the power of index investing and asset allocation with Schwab MarketTrack Portfolios®.

These four portfolios offer a choice of asset allocations with varying levels of potential risk.

Get a diversified retirement portfolio with Schwab Target Date Funds.

How it works

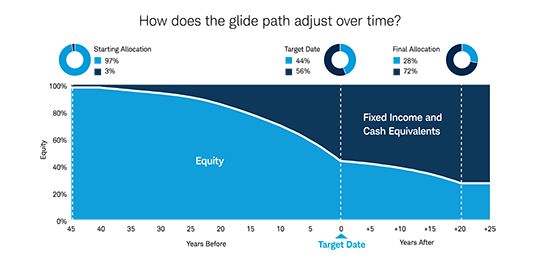

Target date funds are designed to help you avoid one of the most common investing pitfalls—failing to adjust your portfolio for your changing financial needs over time. With Schwab Target Date Funds, Schwab Asset Management reallocates the fund's investments along what is called a "glide path," moving from more aggressive to more conservative as the target date approaches and beyond, helping to reduce risk and prepare you for retirement.

Generate income in retirement with Schwab Monthly Income Funds.¹

Three fund options to help meet your income needs.

How it works

Schwab Monthly Income Funds are a suite of three all-in-one mutual funds designed to help meet investors' retirement or other income needs. Schwab Asset Management allocates asset classes according to the payout policy of each Fund.

|

Schwab Monthly Income Fund - Income Payout (SWLRX) |

Schwab Monthly Income Fund - Flexible Payout (SWKRX) |

Schwab Monthly Income Fund - Target Payout (SWJRX) |

|

|---|---|---|---|

|

Managed Payout Policy |

Designed to offer an annual payout based on underlying fund yields and the market environment | Designed to offer a targeted annual payout during most market environments and seeks to maximize annual payout while maintaining or growing the level of original investment over the long term | Designed to offer a targeted annual payout of approximately 5% during most market environments |

| Target Annual Payout |

0%–3% low-rate environment 3%–5% normal-rate environment5%+ high-rate environment

|

4%–6% | 5% |

|

Payout Source |

|

|

|

†A return of capital is a distribution from the shareholder’s investment principal, rather than net profits from the Fund’s returns. Shareholders who receive periodic distributions consisting of a return of capital may be under the impression that they are receiving net profits when they are not. Return of capital reduces your cost basis in the Fund’s shares and is not taxable to you until your cost basis has been reduced to zero.

Ready to start investing

-

Ready to start investing?

-

Already have an account?

Questions? We're ready to help.

-

Call

Call -

Chat

Chat -

Visit

Visit