Wasmer Schroeder™ bond ladder strategies.

Designed to help minimize interest rate volatility.

Bond ladder strategies target a particular maturity exposure across pre-defined ranges. As bonds mature or roll out of target ranges, proceeds are reinvested back into the longer end of the ladder range.

Wasmer Schroeder tax-exempt bond ladder strategies.

Primarily for higher tax bracket investors looking to generate steady income.

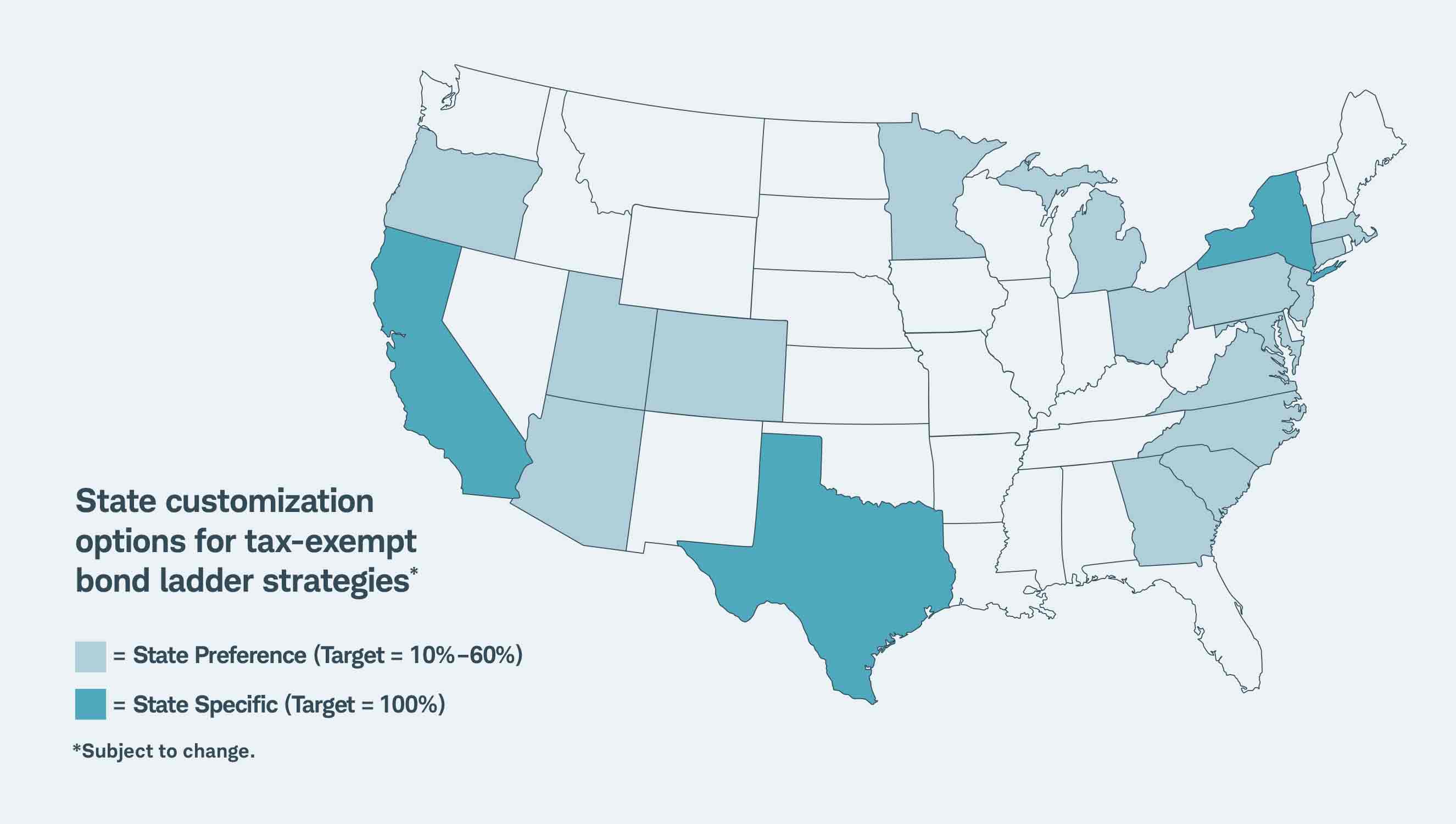

Tax-exempt bond ladder portfolios have customization options in some states.

Maturity dates:

Options from 1–15 years

Fixed income style:

Short-term, intermediate-term, and long-term municipal bonds

Account minimum:

$250,000

Typical Fees*:

- Fees for municipal bond ladder strategies start at 0.35%.

Wasmer Schroeder taxable bond ladder strategies.

Primarily for lower tax bracket investors with a tax-deferred account, such as an IRA, seeking higher yields.

Maturity dates:

Options from 6 months – 10 years

Fixed income style:

Short-term and intermediate-term corporate bonds, and ultra-short-term U.S. Treasuries

Account minimum:

$250,000

Typical Fees*:

- Fees for taxable bond ladder strategies start at 0.55%.

- Fees for U.S. Treasury bond ladder strategies start at 0.15%.

Let's talk about Wasmer Schroeder Strategies for your portfolio.

Frequently asked questions about Wasmer Schroeder bond ladder strategies.

- Fees for taxable bond ladder strategies start at 0.55%.

- Fees for municipal bond ladder strategies start at 0.35%.

- Fees for U.S. Treasury bond ladder strategies start at 0.15%.

You may be able to take advantage of lower pricing if you have multiple accounts within your household enrolled in Wasmer Schroeder strategies, provided they are of the same asset class.*

No. Schwab believes in giving investors the freedom to choose from both Schwab products and, through Managed Account Select, products offered by a set of experienced third-party investment management firms. Managed Account Select includes additional choices of actively managed fixed income strategies. Learn more.

No. If you have an existing relationship with a Schwab Financial Consultant, you can continue to work with him or her to review, select, and monitor your managed account. Your Schwab Financial Consultant will communicate with your selected asset manager on your behalf.