Registered Index-Linked Annuities (RILAs)

Whether you're in or near retirement, and you're comfortable with a certain level of market risk, RILAs can help you grow your assets tax-deferred.

What is a RILA?

RILAs offer unique investment strategies intended to help balance performance and protection through index strategies and variable separate accounts. Depending on your investment elections, RILAs allow you to participate in market upswings and partially protect from market downturns. They're also known as hybrid, structured, buffered, and registered annuities.

A RILA might be right for you if:

- You're in or near retirement.

- You're looking for equity-like returns if the index performance is positive, and a level of protection if the index performance is negative.

- You're looking for tax-deferred growth potential.

Benefits of RILA

- Opportunity for tax-deferred growth.

- No contract or admin fees (when investing in indexed strategies).

- RILAs offer unique investment strategies intended to help balance performance potential and protection.

Considerations

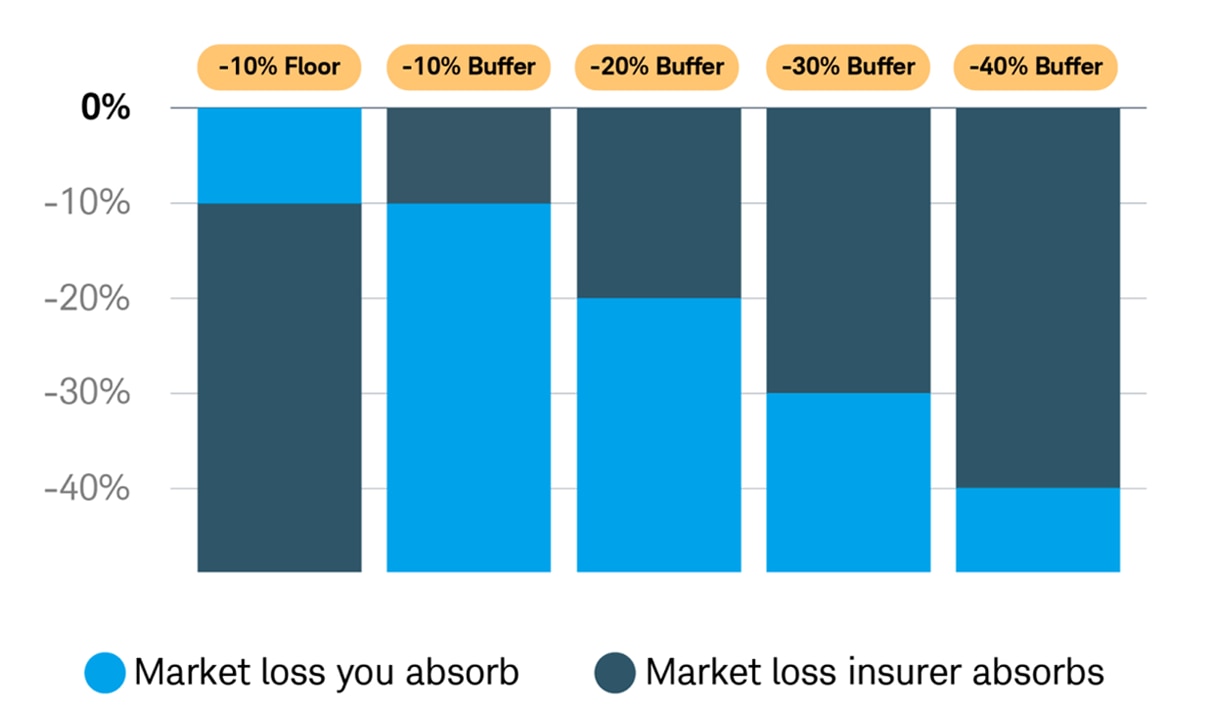

- RILAs are generally tied to the performance of a market index, offering the opportunity to capture positive index returns up to a limit ("cap rate" and “participation rate”), while providing a level of protection ("buffer" and “floor”) if the index return is negative. However, you're not directly invested in either an index or the market.*

- Cap rates and participation (par) rates have the potential to limit your earnings if the markets are performing well.

- You may incur losses if the market drops—either up to the floor limit or when negative performance exceeds the buffer—depending on the level/type of protection selected.*

- Withdrawals will reduce the death benefit and account value. Early withdrawals may be subject to surrender charges.

Why choose Schwab for your annuity solution?

We combine objective guidance, innovative solutions, and decades of experience to help you choose a suitable annuity solution for your retirement or income needs.

Our Annuity Specialists provide unbiased guidance that suits your particular needs (our employees are not paid on commission).

Our dedicated specialists work with your Financial Consultant to provide comprehensive guidance tailored to your goals.

Questions about annuities?

Contact an Annuity Specialist at 866-663-5241 or find a branch.

Customize your RILA for your specific retirement needs.

What index or indices do you want to track?

You earn interest based on the performance of an index (e.g., S&P 500® Index, MSCI EAFE Index, etc.).

How long do you want to invest?

Select your investment time horizon (i.e., product and surrender charge schedule*). Next, select how often performance is measured (e.g., 1-, 3-, or 6-year "term").

How much protection do you want?

Select the level of protection against loss ("buffer" or "floor").

How much growth potential do you want?

Determine the growth potential of your investment by selecting a crediting type ("cap rate" or "participation rate").

How RILAs work

Growth opportunities during up markets

Set your cap or participation rate based on the level of risk you're comfortable with.

Cap rate: The maximum rate that will be credited at the end of a term period (which may be referred to as "maturity date").

Participation (par) rate: The percentage of the underlying index's positive return that's credited at the end of the term period or on the maturity date.

What RILAs are offered through Schwab?

Brighthouse Shield® Level II Annuities

What you get with a Brighthouse Shield Level II Annuity:

- No annual fees

- Death benefit (return of premium)

- Lifetime retirement income

- Downside protection

Issuer: Brighthouse Life Insurance Company

Financial strength–Standard & Poor's:1 A+

State availability: State availability may vary.

Current rates:

Product material:

Midland LiveWell Dynamic RILA®

What you get with a Midland LiveWell Dynamic RILA:

- Flexible investment options

- Death benefit (return of premium or enhanced option for an additional fee)

- Downside protection

- Optional riders (for an additional fee)

Issuer: Midland National® Life Insurance Company

Financial strength–Standard & Poor's:1 A+

State availability: State availability may vary.

Product material: