Schwab margin rates and requirements

Current margin rates

Schwab's current base rate is 10.00% and is subject to change without notice. Last changed on 12/12/2025.

- Debit Balance

- Margin Rate

- Effective Rate

-

Debit Balance$0-$24,999.99Margin RateBase Rate + 1.825%Effective Rate11.825%

-

Debit Balance$25,000-$49,999.99Margin RateBase Rate + 1.325%Effective Rate11.325%

-

Debit Balance$50,000-$99,999.99Margin RateBase Rate + 0.375%Effective Rate10.375%

-

Debit Balance$100,000-$249,999.99Margin RateBase Rate + 0.325%Effective Rate10.325%

-

Debit Balance$250,000-$499,999.99*Margin RateBase Rate + 0.075%Effective Rate10.075%

* For balance tiers $500K and above, call 877-752-9749 for more information about our latest rate offers.

It is important to keep in mind the following:

- It is possible that margin interest rates may fluctuate during the time you have an outstanding loan.

- Interest is calculated daily on the amount borrowed and posted to the account on a monthly basis.

- Like any other loan, you must repay your margin loan along with interest, regardless of the underlying value of any securities you might have purchased with margin.

Margin requirements

- To begin margin borrowing against securities in a Schwab brokerage account, you need at least $2,000 in cash or marginable securities.1

- The amount you can borrow on margin is typically limited to 50% of the value of marginable securities in your account.

- Once you borrow on margin, you are required to maintain a certain amount of Tooltip in your account, depending on the securities you hold.

- The typical Tooltip is at least 30% of the total account value but can be higher for certain securities or accounts.

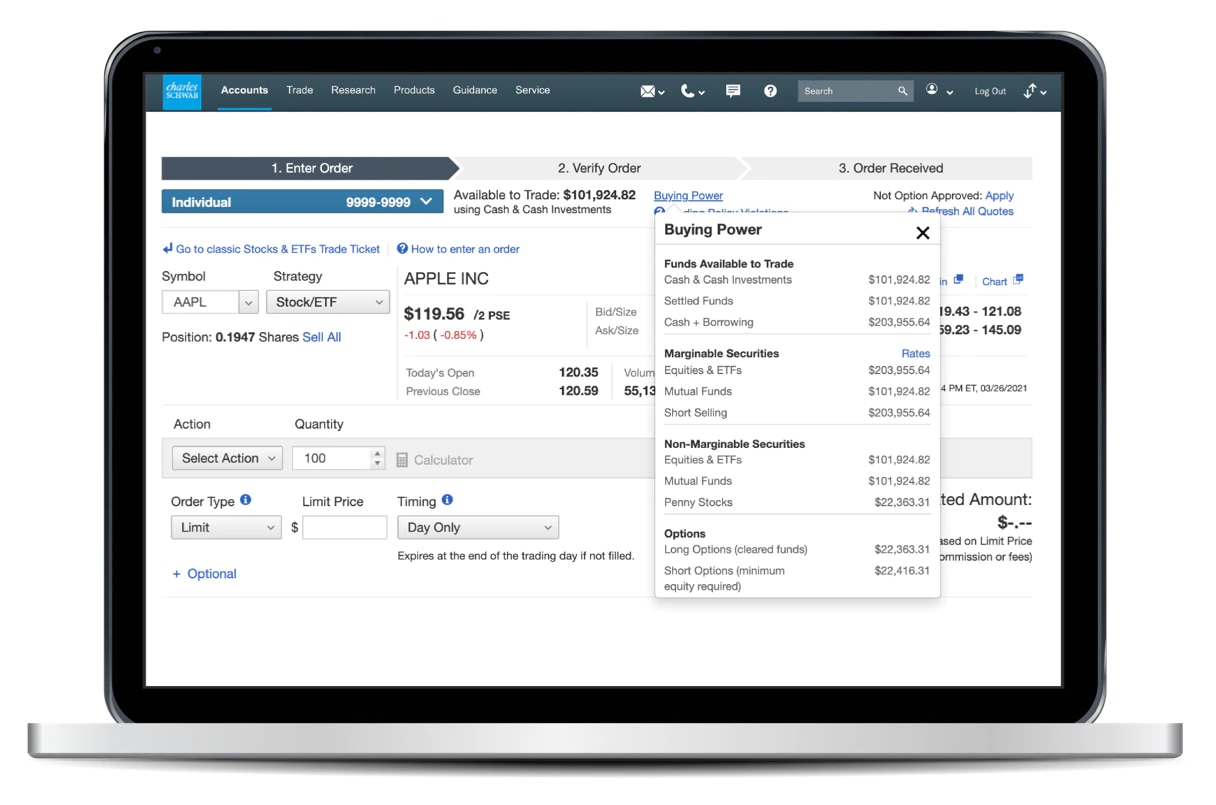

- Schwab calculates your buying power and cash available for withdrawal and provides the information with your Schwab brokerage account.

- In certain instances, Schwab may impose Tooltip to protect clients from greater exposure to market risk.

- are subject to a number of .

Listed below are combined requirements for buying and borrowing against securities in a margin account based on Federal Reserve Board Regulation T ("Reg T"), FINRA regulations, and Schwab rules.

Combined requirements

-

Equities table Long: Common, Non-Leveraged ETFs/ETNs, Preferred & Warrants Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance ≥ $3.00 per share Lesser of $2,000 or 100% market value 50% of cost 30% of market value < $3.00 per share 100% market value 100% of cost 100% of market value Short Sale: Common, Non-Leveraged ETFs/ETNs, Preferred & Warrants Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance > $16.66 $2,000 50% net proceeds 30% short market value $5.00–$16.66 $2,000 50% net proceeds $5 per share $2.50–$4.99 $2,000 50% net proceeds 100% short market value < $2.50 $2,000 50% net proceeds $2.50 per share Other Equity Types/Positions Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance Mutual Funds1 Lesser of $2,000 or 100% market value 50% of cost 30% of market value Money Market Funds1 Lesser of $2,000 or 100% market value 10% of cost 10% of market value Boxed Positions $2,000 10% of market value 10% of market value Long: Leverage ETFs/ETNs Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance 2X Leveraged ETFs/ETNs Lesser of $2,000 or 100% market value 50% of cost 50% of market value 3X Leveraged ETFs/ETNs Lesser of $2,000 or 100% market value 75% of cost 75% of market value Short Sale: Leveraged ETFs/ETNs Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance 2X Leveraged ETFs/ETNs > $8.33/share $2,000 60% of net proceeds 60% short market value $5.00–$8.33/share $2,000 $5.00/share $5.00/share $2.50–$4.99/share $2,000 100% 100% < $2.50/share $2,000 $2.50/share $2.50/share 3X Leveraged ETFs/ETNs Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance > $5.55/share $2,000 90% of net proceeds 90% short market value $5.00–$5.55/share $2,000 $5.00/share $5.00/share $2.50–$4.99/share $2,000 100% 100% < $2.50/share $2,000 $2.50/share $2.50/share 1 Not marginable until 30 days after the purchase settles (100% initial requirement).

Exchange-Traded Products are subject to risks similar to those of stocks. Investment returns will fluctuate and are subject to market volatility, so that an investor's shares, when redeemed or sold, may be worth more or less than their original cost.

-

Options table Options - Long Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance Req. Equity Option Foreign Currency OptionIndex Options (Broad-based Index and Narrow-based Index)Lesser of $2,000 or 100% market value 100% of cost Same as Initial Requirement Options - Short Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance Req. Naked Calls (Broad-based Index) $5,000 Greater of: - 15% underlying value - out of the money amount + premium (20% for ETNs)

- 10% underlying value + premium

- $100 per contract

Greater of minimum equity requirement or initial requirement Naked 2X Leveraged ETF/ETN Calls (Broad-based Index) $5,000 Greater of: - 30% underlying value - out of the money amount + premium (40% for ETNs)

- 20% underlying value + premium

- $100 per contract

Greater of minimum equity requirement or initial requirement Naked 3X Leveraged ETF/ETN Calls (Broad-based Index) $5,000 Greater of: - 45% underlying value - out of the money amount + premium (60% for ETNs)

- 30% underlying value + premium

- $100 per contract

Greater of minimum equity requirement or initial requirement Naked Puts (Broad-based Index) Lesser of $5,000 or max loss Greater of: - 15% underlying value - out of the money amount + premium (20% for ETNs)

- 10% Contract Value + premium

- $100 per contract or max loss

Greater of minimum equity requirement or initial requirement Naked 2X Leveraged ETF/ETN Puts (Broad-based Index) Lesser of $5,000 or max loss Greater of: - 30% underlying value - out of the money amount + premium (40% for ETNs)

- 20% Contract Value + premium

- $100 per contract or max loss

Greater of minimum equity requirement or initial requirement Naked 3X Leveraged ETF/ETN Puts (Broad-based Index) Lesser of $5,000 or max loss Greater of: - 45% underlying value - out of the money amount + premium (60% for ETNs)

- 30% Contract Value + premium

- $100 per contract or max loss

Greater of minimum equity requirement or initial requirement Straddle/Combo (Broad-based Index) $5,000 Uncovered requirements for the leg with the higher naked requirement, plus the premium of the other leg Greater of minimum equity requirement or initial requirement Spread (Broad-based Index) $0/$5,000 Credit Spread: Difference in strike prices x 100 x number of contracts Debit Spread: 100% of costGreater of minimum equity requirement or initial requirement Complex Spread (Broad-based Index) Apply only to the following strategies:- Box Spreads

- Butterfly Spreads

- Condor Spreads

- Iron Butterfly Spreads

- Iron Condor Spreads

+All component option legs must have the same expiration date.$0/$5,000 Lesser of:

i) Sum of component initial naked requirements

ii) Maximum potential loss of strategyGreater of minimum equity requirement or initial requirement Options - Short, cont. Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance Req. Naked Calls Options (Narrow-based Index) $5,000 Greater of: - 20% underlying value - out of the money amount + premium

- 10% underlying value + premium

- $100 per contract

Greater of minimum equity requirement or initial requirement Naked 2X Leveraged ETF/ETN Calls (Narrow-based Index) $5,000 Greater of: - 40% underlying value - out of the money amount + premium

- 20% underlying value + premium

- $100 per contract

Greater of minimum equity requirement or initial requirement Naked 3X Leveraged ETF/ETN Calls (Narrow-based Index)

$5,000 Greater of: - 60% underlying value - out of the money amount + premium

- 30% underlying value + premium

- $100 per contract or max loss

Greater of minimum equity requirement or initial requirement Naked Puts (Narrow-based Index)

Lesser of $5,000 or max loss Greater of: - 20% underlying value - out of the money amount + premium

- 10% Contract Value + premium

- $100 per contract or max loss

Greater of minimum equity requirement or initial requirement Naked 2X Leveraged ETF/ETN Puts (Narrow-based Index)

Lesser of $5,000 or max loss Greater of: - 40% underlying value - out of the money amount + premium

- 20% Contract Value + premium

- $100 per contract or max loss

Greater of minimum equity requirement or initial requirement Naked 3X Leveraged ETF/ETN Puts (Narrow-based Index)

Lesser of $5,000 or max loss Greater of: - 60% underlying value - out of the money amount + premium

- 30% Contract Value + premium

- $100 per contract or max loss

Greater of minimum equity requirement or initial requirement Straddle/Combo (Narrow-based Index)

$5,000 Uncovered requirements for the leg with the higher naked requirement, plus the premium of the other leg Greater of minimum equity requirement or initial requirement Spread (Narrow-based Index)

$0/$5,000 Credit Spread: Difference in strike prices x 100 x number of contracts Debit Spread: 100% of cost Greater of minimum equity requirement or initial requirement Complex Spread (Narrow-based Index) Apply only to the following strategies:- Box Spreads

- Butterfly Spreads

- Condor Spreads

- Iron Butterfly Spreads

- Iron Condor Spreads

+All component option legs must have the same expiration date.$0/$5,000

Lesser of: i) Sum of component initial naked requirementsii) Maximum potential loss of strategyGreater of minimum equity requirement or initial requirement

Equity

Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance Req. Naked Calls

$5,000 Greater of: - 20% underlying value - out of the money amount + premium

- 10% underlying value + premium

- $100 per contract

Greater of minimum equity requirement or initial requirement Naked Puts

Lesser of $5,000 or max loss Greater of: - 20% underlying value - out of the money amount + premium

- 10% contract value + premium

- $100 per contract

Greater of minimum equity requirement or initial requirement Straddle/Combo

$5,000 Uncovered requirements for the leg with the higher naked requirement, plus the premium of the other leg Greater of minimum equity requirement or initial requirement Spread

$0/$5,000 Credit Spread: Difference in strike prices x 100 x number of contracts Debit Spread: 100% of cost Greater of minimum equity requirement or initial requirement Complex Spread Apply only to the following strategies):- Box Spreads

- Butterfly Spreads

- Condor Spreads

- Iron Butterfly Spreads

- Iron Condor Spreads

+All component option legs must have the same expiration date.$0/$5,000 Lesser of: i) Sum of component initial naked requirementsii) Maximum potential loss of strategyGreater of minimum equity requirement or initial requirement Protective Put

Lesser of $2,000 or 100% market value Lesser of: i) 10% of exercise price + out of the money amountii) Long stock requirementGreater of minimum equity requirement or initial requirement Protective Call

$2,000 Lesser of: i) 10% of exercise price + out of the money amountii) Short stock requirementGreater of minimum equity requirement or initial requirement Conversion

Lesser of $2,000 or 100% market value 10% of exercise price Greater of minimum equity requirement or initial requirement Reverse Conversion

$2,000 10% of exercise price Greater of minimum equity requirement or initial requirement Collars with Long Equity Lesser of $2,000 or 100% market value Lesser of: i) 10% of put exercise price + put out of the money amountii) 25% of call exercise priceGreater of minimum equity requirement or initial requirement Cash Secured Equity Puts (CSEP) - $2,000

Account holders must hold and maintain assignment value in cash or cash equivalents:

- Money Market Funds

- Treasury Bills, Notes or Bonds maturing in less than a year

Account holders must hold and maintain assignment value in cash or cash equivalents including: - Cash

- Money Market Funds

- Cash Equivalents which include:

• Cash Deposits

• Schwab Bank Deposits

• Schwab Value Advantage Funds

• Schwab Money Market Funds

• Treasury Bills, Notes or Bonds maturing in less than a year

Account holders must hold and maintain assignment value in cash or cash equivalents including: - Cash

- Money Market Funds

- Cash Equivalents which include:

• Cash Deposits

• Schwab Bank Deposits

• Schwab Value Advantage Funds

• Schwab Money Market Funds

• Treasury Bills, Notes or Bonds maturing in less than a year

- IRA account initial minimum requirement for spreads is $5,000; special minimums, when applicable under select offers, supersede published minimums.

- All component option legs must have the same expiration date.

-

Debt table Security Type Initial Min Equity Req. Schwab Initial Req. Schwab Maintenance Req. Corporate Bond Coupon Corporate Bond Non-ConvertibleLesser of $2,000 or 100% market value 30% of cost Greater of 30% market value or 20% of principal, not to exceed 100% market value Corporate Bond Convertible Lesser of $2,000 or 100% market value 50% of cost Greater of 30% market value or 20% of principal, not to exceed 100% market value Government Agency Coupon Government Agency StripGovernment Agency Pass-throughGovernment Agency CMOLesser of $2,000 or 100% market value 20% of cost Greater of 20% market value or 15% of principal, not to exceed 100% market value Municipal Bond Coupon Lesser of $2,000 or 100% market value 25% of cost Greater of 25% market value or 15% of principal, not to exceed 100% market value Treasury Bill Lesser of $2,000 or 100% market value 10% of cost 1% market value Treasury Coupon Lesser of $2,000 or 100% market value 10% of cost - 1 year but less than 3 years to maturity: 2% mkt. value

- 3 years but less than 5 years to maturity: 3% mkt. value

- 5 years but less than 10 years to maturity: 4% mkt. value

- 10 years but less than 20 years to maturity: 5% mkt. value

- 20 years or more to maturity: 6% mkt. value

Treasury STRIP Lesser of $2,000 or 100% market value 10% of cost - 1 year but less than 3 years to maturity: 2% mkt. value

- 3 years but less than 5 years to maturity: 3% mkt. value

- 5 years but less than 10 years to maturity: greater of 4% mkt. value or 3% of principal amount

- 10 years but less than 20 years to maturity: greater of 5% mkt. value or 3% of principal amount

- 20 years or more to maturity: greater of 6% mkt. value or 3% of principal amount

Unit Investment Trust Not Marginable Not Marginable Not Marginable State, Municipal and Corporate bonds, with an investment grade rating (IG) or better, are marginable.

Fixed-income investments are subject to various risks, including changes in interest rates, credit quality, market valuations, liquidity, prepayments, early redemption, corporate events, tax ramifications, and other factors. For further details, please feel free to contact a Schwab Fixed Income Specialist at 877-563-7818.

What is a margin call?

When the equity in your margin account drops below the minimum maintenance requirement (30% for most securities), it can trigger a margin call or Tooltip . This means you'll have to deposit cash or securities into your account to meet the minimum equity requirement. Otherwise, Schwab may have to sell securities in your account at the current market value.

- Schwab may notify you of a margin call by phone, email, or mail. You can also view your alerts in the message center, which is available from the "Messages" link at the top of all pages in this website.

- You can meet a margin call promptly by depositing funds via wire, check (delivered to a branch) or MoneyLink. Or you can liquidate securities, journal cash/securities from other Schwab accounts, or deposit marginable stock.

- You are not entitled to an extension of time to meet a margin call. If you are unable to satisfy a margin maintenance call, Schwab may take the necessary steps to protect its secured loan, including selling some or all of the securities in your account.

- If your account is liquidated and a debit balance remains, you are still required to repay Schwab the amount of money you borrowed on margin, minus whatever proceeds were obtained through the liquidation. If there is a debit balance in your account, Schwab may make arrangements with you to repay the debt.

Why trade margin with Schwab?

Trusted education

Access educational resources to learn more about margin and how it might fit into your investing strategy.

Competitive rates

Our competitive margin interest rates can make margin borrowing more cost-effective than other lending options like personal or unsecured loans.

Flexible payment schedule

There is no set repayment schedule as long as you maintain the required level of Tooltip in your account.

All in one place

As a Schwab client, you can manage your margin loan alongside your investments and other finances in a single, convenient location.

Get started with margin in three simple steps.

Have an eligible account

A Schwab brokerage account with at least $2,000 in cash or marginable securities is required to use margin. Don't have an account with us yet? Open an account online or call 866-855-9102.

Verify you're margin approved

Once logged into your account, visit the Margin & Options Access page to view your margin access status and apply for approval if needed.

Tap into available funds

Use your margin account to place trades with enhanced buying power or to withdraw funds as a short-term loan.1

Ready to start using margin?

Already a Schwab client?

Log in to your brokerage account to view margin access status and apply for margin if needed.