Your Guest Pass is active.

How to use your thinkorswim® Guest Pass:

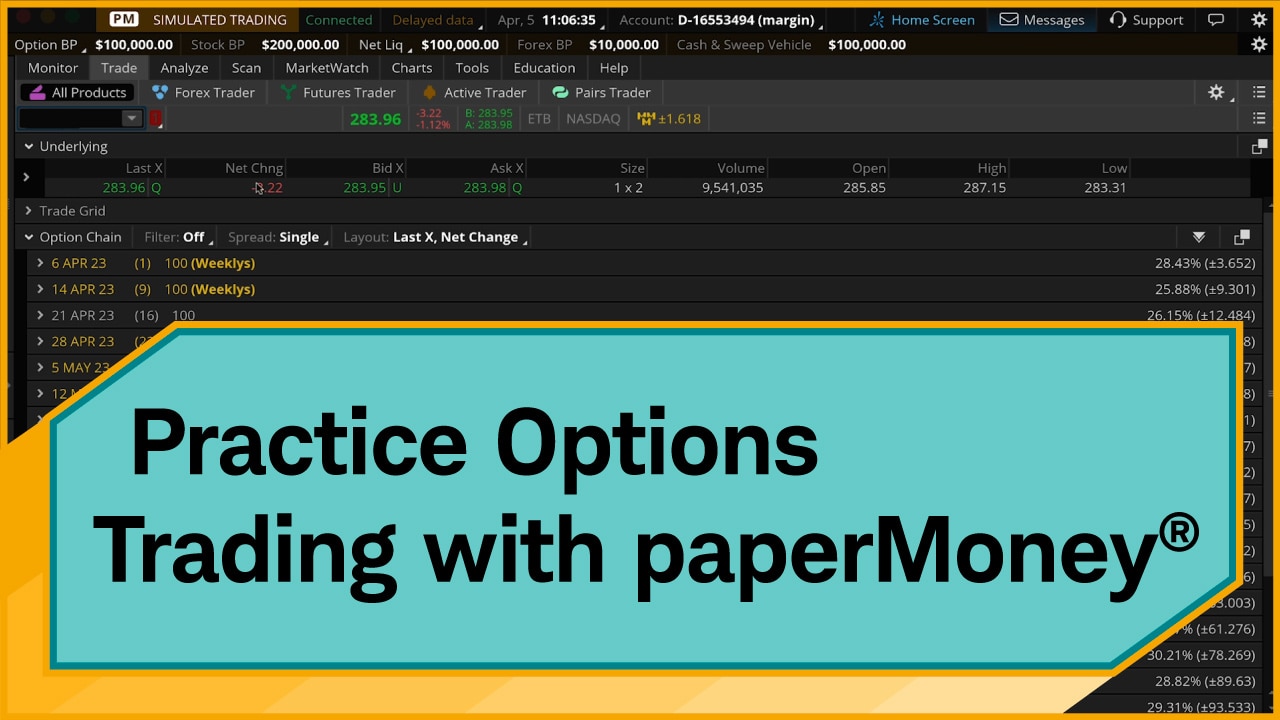

Once you've signed up for a Guest Pass, use the credentials you created to access the simulated market environment paperMoney®1 within any of the thinkorswim platforms.

thinkorswim web

Taking the essential trading functionality from the thinkorswim desktop, this platform is streamlined and optimized for web access.

Take thinkorswim for a test-drive—no Schwab account required.

With a thinkorswim Guest Pass, you'll have 30 days to explore and use any of our thinkorswim trading platforms. Test your strategies in a simulated market environment using industry-leading charting, analysis, and trading tools.

A hassle-free way to try thinkorswim

No need to open and fund a Schwab account or transfer positions.

Analyze, trade, and monitor in a simulated market environment

Use thinkorswim to test your strategies and explore new ones.

$100,000 of virtual buying power is yours to use

Trade equities, options3, futures4, and forex4 with simulated buying and margin features.

Maximize your thinkorswim Guest Pass experience with these helpful tutorials.

As a Guest Pass user, you'll be using the same paperMoney simulated trading environment that clients have access to. Check out these videos to learn how to test your strategies risk-free.

Frequently Asked Questions

Please be sure to write down or save your Guest Pass username and password, as we will not be able to provide them to you if misplaced. If that happens, you'll need to create a new Guest Pass account using a different email address.

After your 30-day Guest Pass trial period ends, your credentials will expire and can no longer be used. A Guest Pass can't be extended; however, you can get unlimited access to thinkorswim trading platforms with a Schwab brokerage account. You can open an account online in minutes, and there are no account minimums and no opening or maintenance fees (standard pricing applies to trades placed through the platforms).

No. A Schwab brokerage account cannot be used to log in to or access a thinkorswim Guest Pass account. After the 30-day trial ends, your Guest Pass credentials expire, and your account data and settings are no longer accessible. But as a Schwab client, you'll have unlimited access to thinkorswim trading platforms and the paperMoney® feature, so you can test and optimize your trading strategies using paperMoney. You will also be able to toggle thinkorswim to "live trading" and put what you've learned into action.

paperMoney is the simulated market environment built into the thinkorswim trading platforms. It's designed to give Schwab clients a risk-free way to practice and refine their trading strategies using thinkorswim tools with virtual buying power utilizing real-time simulated market data. A thinkorswim Guest Pass provides a way to access paperMoney for 30 days—no Schwab brokerage account required. The simulated environment allows you to see what it's like to trade your strategies using thinkorswim.

As a Schwab client, you don't need a thinkorswim Guest Pass. You already have unlimited access to the full suite of thinkorswim trading platforms with paperMoney built in. Log in here to learn how to access the platforms.

Please be sure to write down or save your Guest Pass username and password, as we will not be able to provide them to you if misplaced. If that happens, you'll need to create a new Guest Pass account using a different email address.