Schwab Managed Portfolios: Asset Allocation

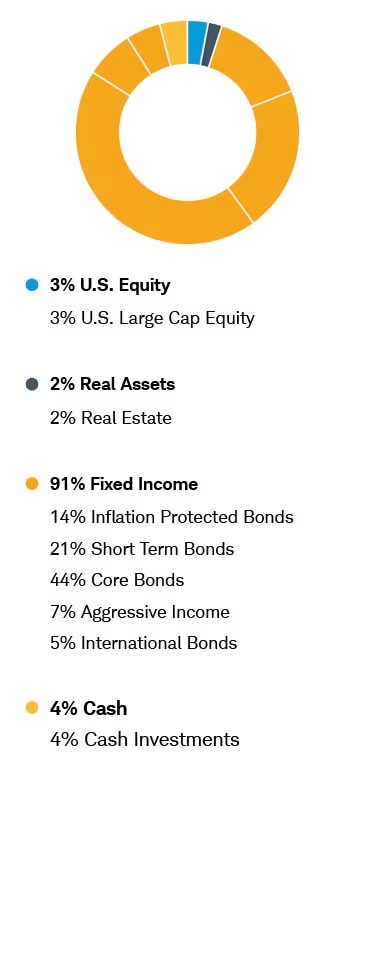

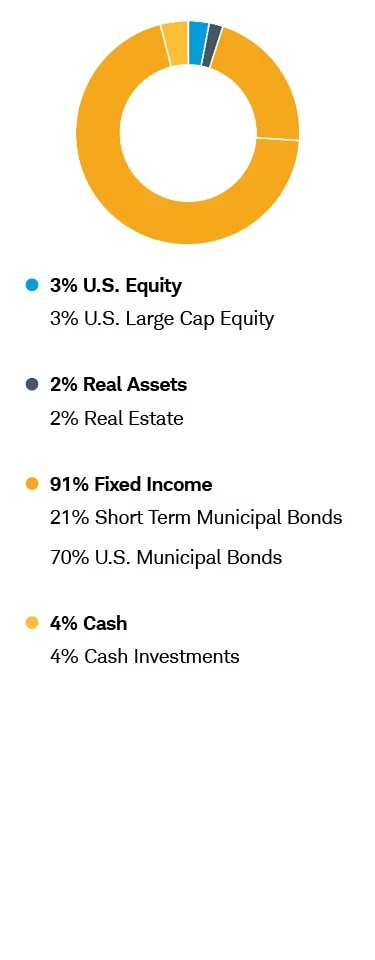

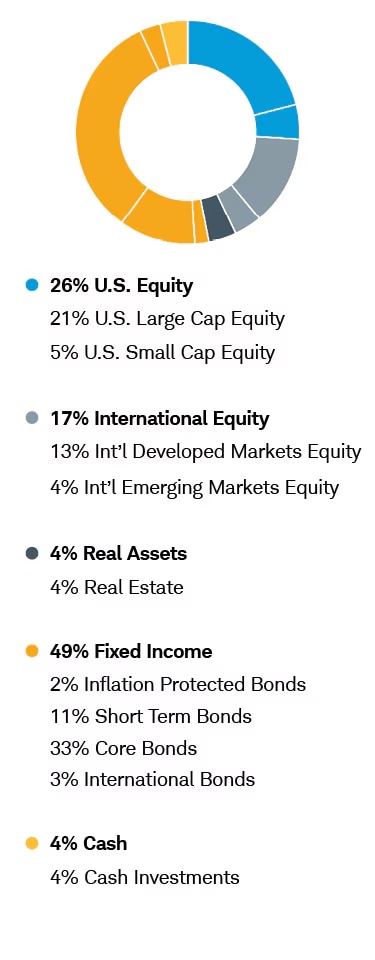

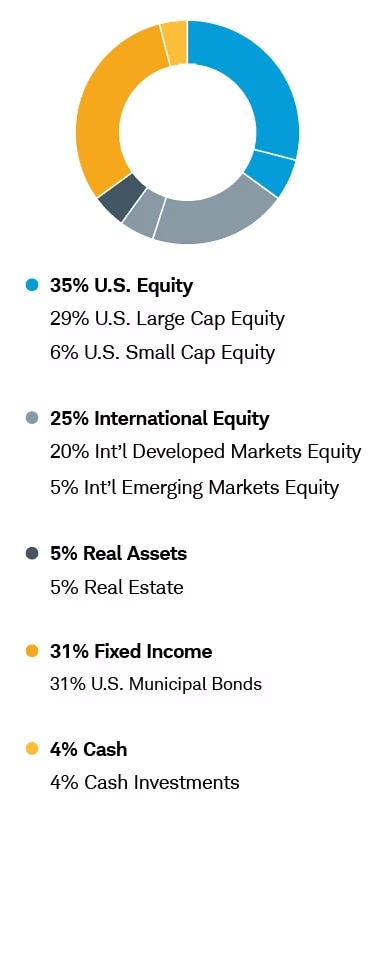

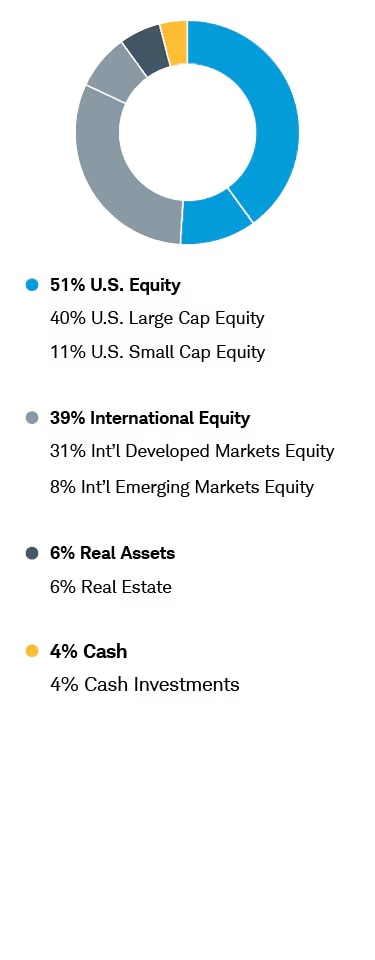

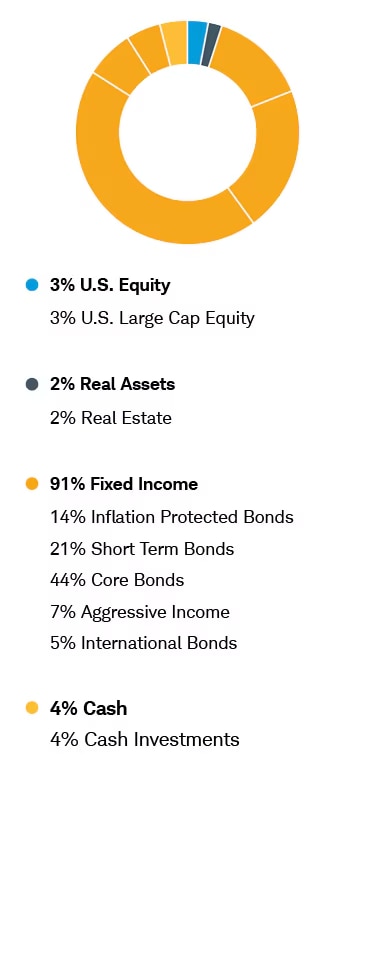

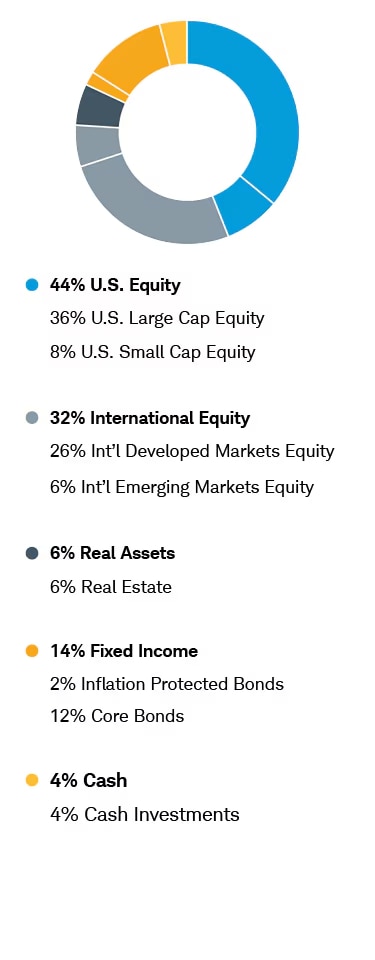

Schwab Managed Portfolios—Mutual Funds

With Schwab Managed Portfolios™—Mutual Funds you'll discover a convenient yet sophisticated way to get the diversification you need. Each portfolio is managed for you by the investment professionals at Schwab Asset Management®.

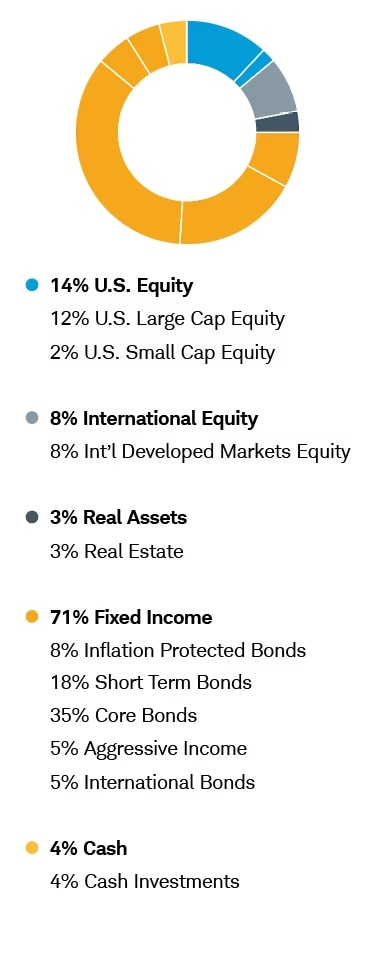

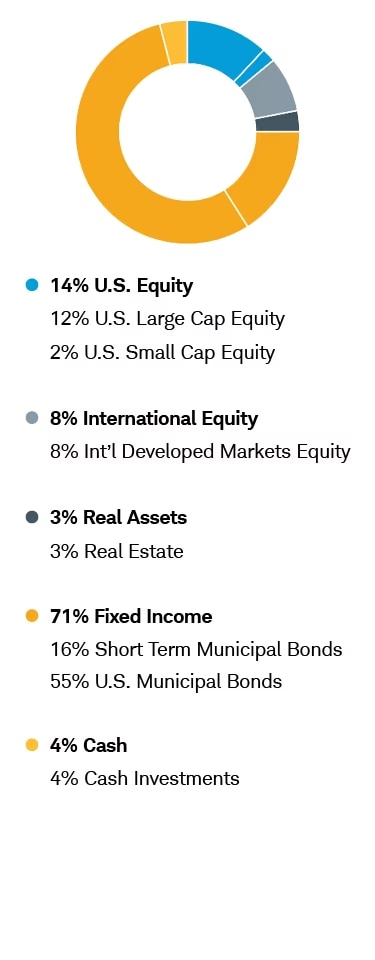

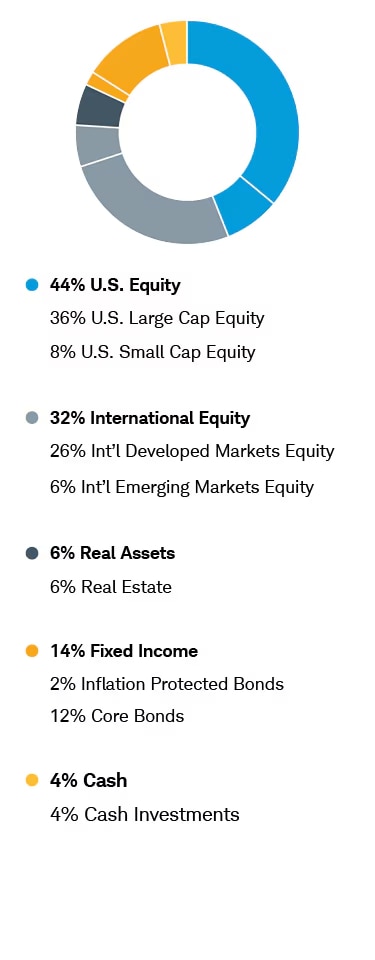

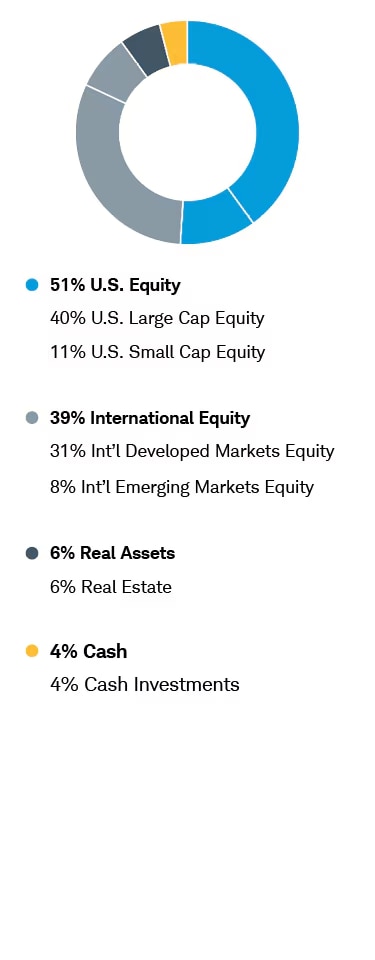

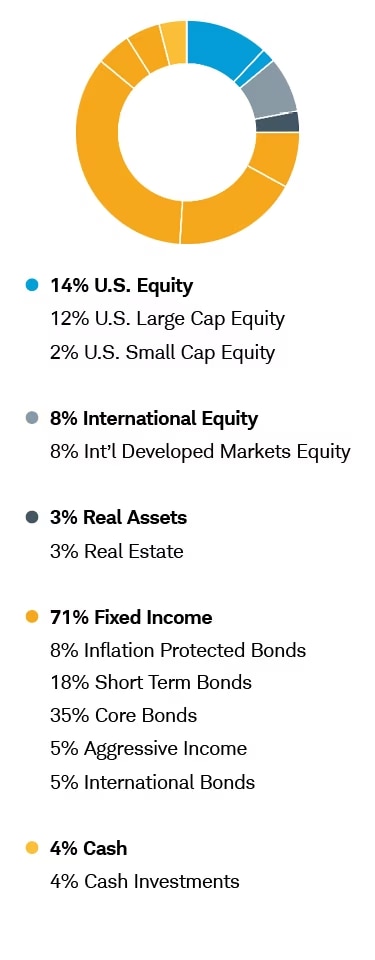

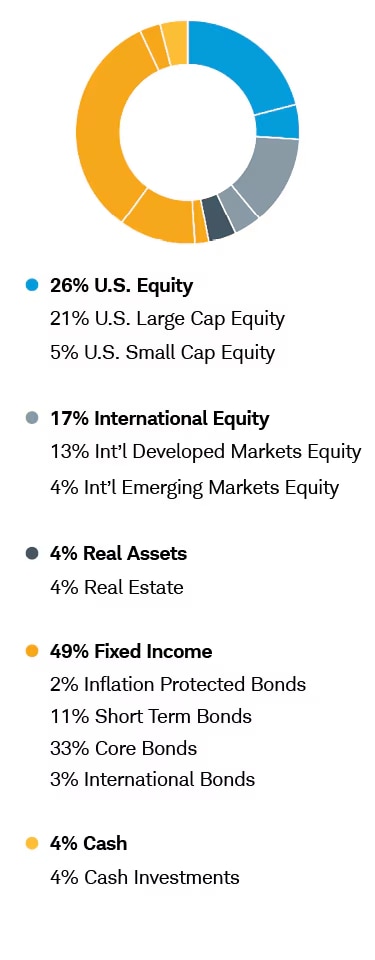

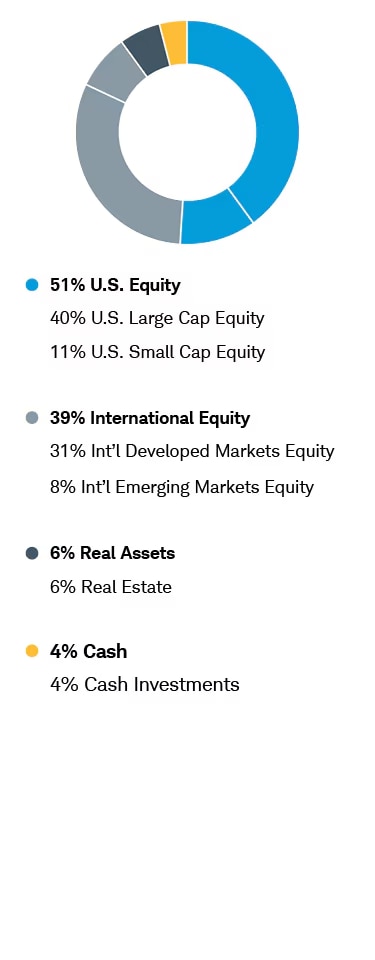

Schwab Managed Portfolios—ETFs

Schwab Managed Portfolios™—ETFs offer broadly diversified, professionally managed portfolios of ETFs designed to match your investment strategy and tolerance for risk. Each ETF portfolio is managed for you by the investment professionals at Schwab Asset Management.

Questions? We're ready to help.

-

Call

Call -

Chat

Chat -

Visit

Visit