You don't need a lot to get started.

Take a minute to envision some of your biggest hopes and dreams. Maybe you hope to pay off your student loans, own your own home, and even retire in style. Now, think about what it'd take to realize those dreams. If you're not quite sure, you're not alone.

For starters, no two people are alike, meaning there's no one "right" way to work toward your goals. Plus, when your goal is especially ambitious—such as saving for the down payment on a new home—figuring out how to save and invest enough while still making ends meet can feel daunting.

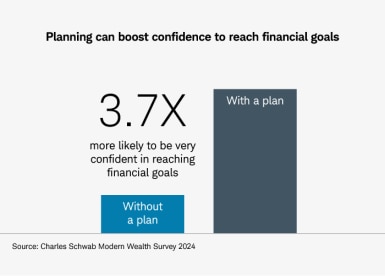

The good news? Financial planning can help. Whether you like to plan everything to the last detail or just want a high-level roadmap to help reach your goals, our research has shown that having a written financial plan gives planners a lot more confidence in reaching their goals compared to non-planners (see "Planning for success" below).

"A financial plan doesn't have to be rigid or complex—and it certainly doesn't depend on how much money you have," said Rob Williams, managing director of financial planning, retirement income, and wealth management at the Schwab Center for Financial Research. "It's all about nailing down your goals and determining what steps you can take to get there."

Planning for success

Based on findings from a Schwab survey, those who have a plan were 3.7 times (15.9% without a plan versus 59% who have a plan) more likely to claim that they're very confident in reaching their goals.*

What makes planning so powerful? Simply put, it helps you:

- Identify what's important: Listing your goals can help you to recognize what's most consequential to you and your family.

- Set priorities: Not all goals are created equal, and a plan can help you prioritize your savings when confronting multiple objectives.

- Stay focused: A carefully considered plan gives you something solid to work toward, which can help you to look past the ups and downs of daily life.

- Go further: After setting goals and starting to invest, it's likely that other life events may arise. With a financial plan firmly in place, you can reevaluate your goals and expand your plan over time.

Bottom line

Creating a solid financial plan can help you steadily build wealth—and the best way to start planning is by turning your dreams into specific financial goals.

-

How to set effective financial goals