Access stock market research with timely, fact-based insights from Schwab and leading independent providers.

Indices - View the latest movements of the most popular domestic and international indices, or dive in for a closer look.

Sectors & industries - See how sectors are trending at a glance with heat maps based on your chosen time frame.

Breaking news - See the latest headlines to help you stay on top of the markets.

Schwab insights and commentary - Receive timely market and economic analysis from our specialists so you can make more informed investing decisions. View our latest market insights.

Market reports - Get a balanced perspective with premium, independent research from third-party firms, including Morningstar® and Argus. See a sample report.

Find and analyze possible opportunities with investment research tools that help you filter out the noise.

These convenient features can help you quickly find potential trade opportunities.

Schwab Stock List™

These lists offer a convenient way to find top-ranked companies based on factors like Analyst Ratings, Price Performance, and more.

Select Lists

ETFs and mutual funds on our Select Lists have been screened to provide a basic standard of liquidity, viability, and structural stability to help you make more informed investing decisions.

Screeners

Use pre-defined screens or customize your own to find trade candidates that fit your criteria.

Once you have a trade idea in mind, these easy-to-use and customizable tools can help you conduct detailed analysis on a wide range of data and information.

Charts

Analyze price movement, volume, and more with interactive price charts and an array of overlaid indicators and comparisons.

Quotes

Access the latest pricing information, historical performance data, and other critical financial metrics of any potential trade or investment, such as dividends, expected earnings, and more.

Access data-driven resources and support to help inform your decisions.

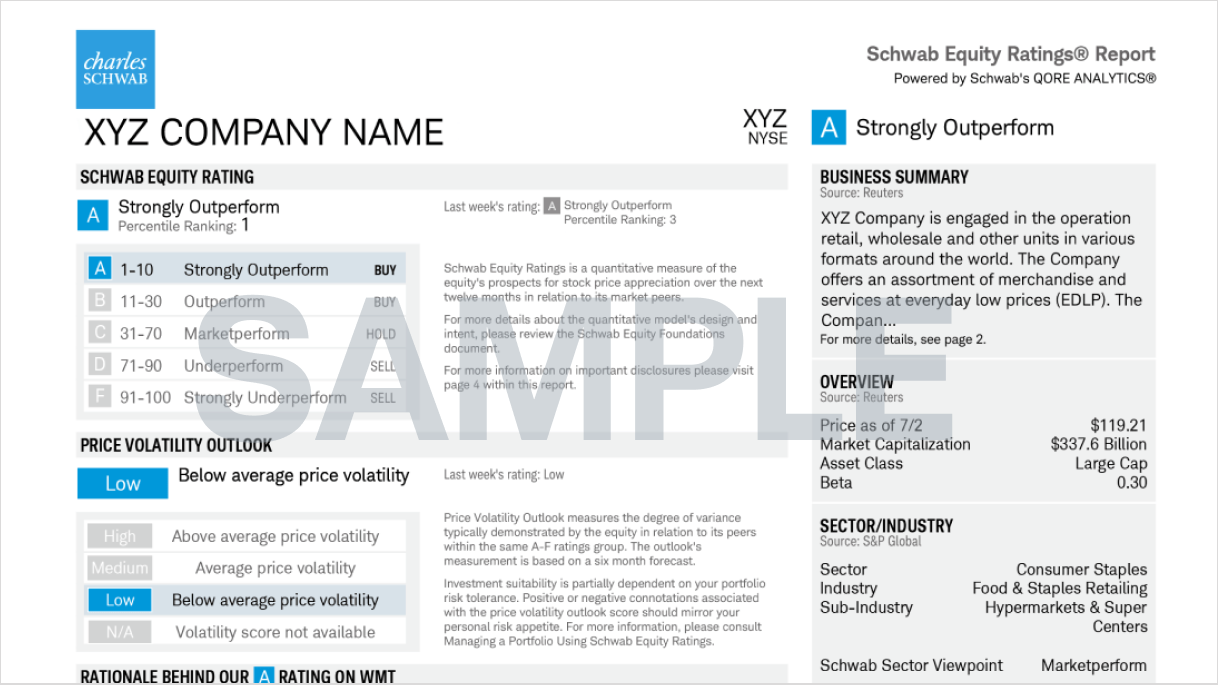

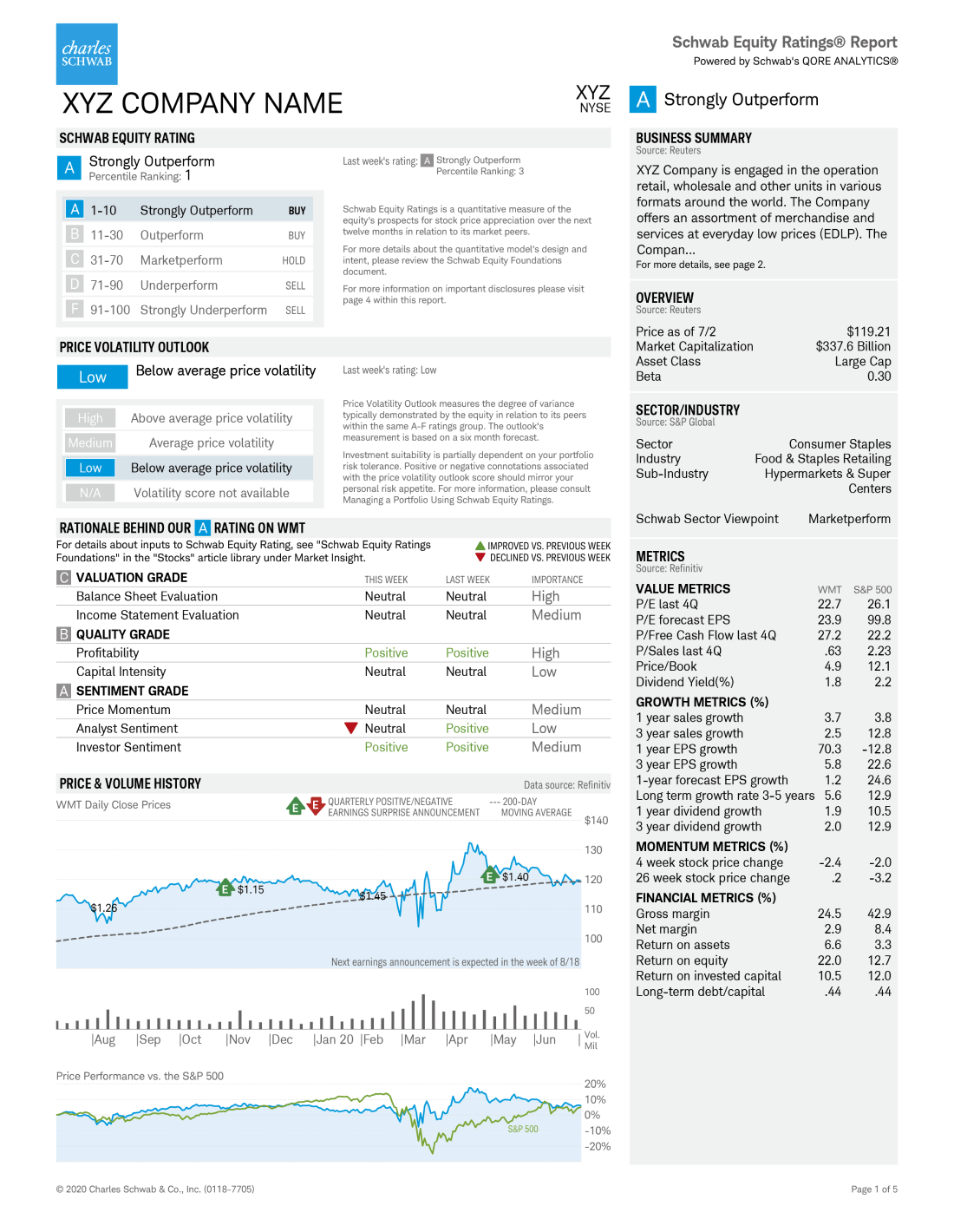

SER-REPORT

Bull or bear?

With the Schwab Trading Activity Index™ (STAX), you can get insights into investor sentiment based on real trading behavior of Schwab clients.