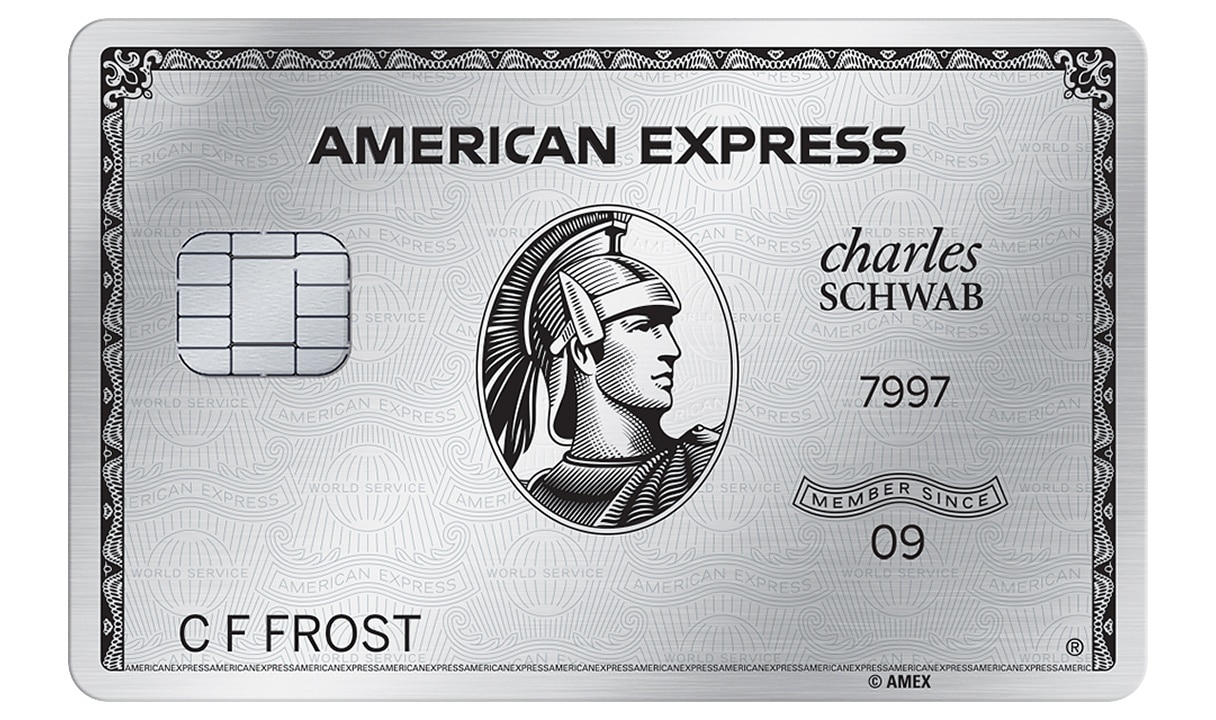

The Platinum Card® from American Express Exclusively for Charles Schwab

Premium Rewards, Services, and Experiences.

The Platinum Card® from American Express Exclusively for Charles Schwab is only available to clients who maintain an eligible Schwab account.ǂ*

80,000 Membership Rewards® points

You can earn 80,000 Membership Rewards® points after spending $8,000 in purchases on your Platinum Card® from American Express Exclusively for Charles Schwab in your first 6 months of Card Membership.†

Annual Fee: $895†¤

Or call us at 800-297-8017.

¤ Rates & Fees | ǂ Benefit Terms | † Offer Terms

Platinum Card® from American Express Exclusively for Charles Schwab

Watch your rewards add up

Benefits for Schwab clients

-

Earn Membership Rewards® pointsǂ

Watch Membership Rewards® points add up. When you use your Platinum Card® from American Express Exclusively for Charles Schwab, you can earn one Membership Rewards® point for every dollar you spend on eligible purchases.ǂ

Use Pay With Points at Checkout to treat yourself to rewards from a variety of partners including travel, shopping, dining and entertainment.ǂ

-

Invest with rewardsǂ

Use Membership Rewards® points for deposits by Schwab to your eligible brokerage account.ǂ

-

Annual Schwab Appreciation Bonusǂ

You can receive: (1) a $100 Card statement credit if your qualifying Schwab holdings are equal to or greater than $250,000 and less than $1,000,000; (2) a $200 Card statement credit if your qualifying Schwab holdings are equal to or greater than $1,000,000 and less than $10,000,000; or (3) a $1,000 Card statement credit if your qualifying Schwab holdings are equal to or greater than $10,000,000, in each case when measured following Card account approval and annually thereafter. Terms and limitations apply.ǂ

More Platinum Card® benefits

$400 Resy Credit

With the $400 Resy Credit, you can get up to $100 in statement credits each quarter when you use the Platinum Card® to make eligible purchases with Resy, including dining purchases at over 10,000 U.S. Resy restaurants.* Enrollment required.ǂ

*As of 03/2025

$300 Digital Entertainment Credit

Get up to $25 in statement credits each month after you pay for eligible purchases with the Platinum Card® at participating partners. This can be an annual savings of up to $300. To view participating partners, visit americanexpress.com/platinum. Enrollment required.ǂ

$300 lululemon Credit

Enjoy up to $75 in statement credits each quarter when you use The Platinum Card® from American Express Exclusively for Charles Schwab for eligible purchases at U.S. lululemon retail stores (excluding outlets) and lululemon.com. That's up to $300 in statement credits each calendar year. Enrollment required.ǂ

$100 Saks Credit

Get up to $100 in statement credits annually for purchases at Saks Fifth Avenue or saks.com on The Platinum Card® from American Express Exclusively for Charles Schwab. That's up to $50 in statement credits from January through June and up to $50 in statement credits from July through December. No minimum purchase required. Enrollment required.ǂ

Walmart+ Monthly Membership Credit

Receive a statement credit* for one monthly Walmart+ membership (subject to auto-renewal) after you pay for Walmart+ each month with your Platinum Card® from American Express Exclusively for Charles Schwab.ǂ

*Up to $12.95 plus applicable local sales tax. Plus Ups not eligible.

More Ways to Pay

You're in control with more ways to pay. You can choose to:

- Pay your bill in full each month.

- Use the Pay Over Time feature to carry a balance with interest on eligible purchases.

- Use Plan It® to select large purchases and split them into monthly payments with a fixed fee.

There is a limit on the total amount that you can carry as a balance or move into a Plan. Any purchases beyond your limit need to be paid in full when your bill is due.ǂ

shop and travel

-

Enjoy exceptional value with the power of American Express in your pocket.

The Platinum Card® from American Express Exclusively for Charles Schwab is only available to clients who maintain an eligible Schwab account.ǂ *

Annual Fee: $895†¤

Or call us at 800-297-8017.

FAQs

This Card is issued by American Express National Bank. Schwab and American Express National Bank, have partnered together to create the American Express Platinum Card® for Schwab, exclusively designed for Schwab investors like you.

Please note that Schwab is not involved with any credit decision, or in the approval process, for any applicant for the Card.

Individuals 18 years of age or over with a valid U.S. home address (including in the U.S. territories and Puerto Rico) and an eligible Schwab account may apply for a Card account.

An eligible account means (1) a Schwab One® or Schwab General Brokerage Account held in your name or in the name of a revocable living trust where you are the grantor and trustee or (2) a Schwab Traditional, Roth or Rollover IRA that is not managed by an independent investment advisor pursuant to a direct contractual relationship between you and such independent advisor.

If you don't have an eligible Schwab account, you can open one at schwab.com/schwabone or by calling 866-385-1227.

No. You will need to apply and be approved for a new American Express Platinum Card® for Schwab account.

Yes, you can enable access to your americanexpress.com Card account information through your Schwab.com Account Summary page.

For servicing-related questions about your Card account, call the number on the back of your Card.

Membership Rewards-enrolled Card Members get at least 1 Membership Rewards® point for every eligible dollar spent on their Membership Rewards program-enrolled American Express® Card. Choose rewards from over 500 leading brands in travel, gift cards, merchandise, or entertainment, or redeem points for deposits by Schwab into your eligible Schwab account through Invest with Rewards. Terms and Conditions for the Membership Rewards® program apply. Visit membershiprewards.com/terms for more information. Participating partners and available rewards are subject to change without notice.

For the American Express Platinum Card® for Schwab, you can redeem Membership Rewards® points for deposits by Schwab into your eligible Schwab account(s).

You can use the deposits in your eligible Schwab account to purchase investments available through Schwab.

For investment help, please call a Schwab investment professional 24/7 at 866-385-1227 or use our online tools and services to help guide you.

If you have multiple eligible Schwab accounts, each time you make a redemption you will be asked to select the account in which you would like the deposits by Schwab to be made.

Please consult with your tax advisor regarding the tax implications of any reward. See www.americanexpress.com/us/cs-platinum-benefit-terms for benefit terms and conditions.