Watch our how-to videos to help you successfully complete the online planning tool.

Error loading player:

HTML5 player not found

Top questions from investors

- Schwab Intelligent Portfolios Premium at a glance

-

• Minimum amount to start your plan: $25,000

• You may open multiple accounts within your plan to meet different financial goals: $5,000 minimum per account

• Pay a one-time planning fee of $300, and just a $30/month advisory fee after that, you'll get access to unlimited 1:1 guidance from a CERTIFIED FINANCIAL PLANNER™ professional, a digital financial plan that provides a customized roadmap to help reach your goals, as well as interactive online planning tools.

• Commissions: None charged

• Just as if you'd invested on your own, you will pay the operating expenses on the ETFs in your portfolio, which includes Schwab ETFs. We believe cash is a key component of an investment portfolio. Based on your risk profile, a portion of your portfolio is placed in an FDIC-insured deposit at Charles Schwab Bank, SSB. Charles Schwab & Co. Inc. is not an FDIC-insured bank and deposit insurance covers the failure of an insured bank. Charles Schwab & Co., Inc. is a brokerage firm and a member of SIPC, which provides protection for brokerage account assets. Certain conditions must be satisfied for FDIC insurance coverage to apply. Non-deposit products are not insured by the FDIC; are not deposits; and may lose value. Some cash alternatives outside of the program pay a higher yield. See more information below.

- What does a $25,000 minimum mean?

- To enroll in Schwab Intelligent Portfolios Premium, you need to have a minimum of $25,000, though these assets may be held across multiple Schwab Intelligent Portfolios Premium accounts. The minimum for each account is $5,000. If the balance across all your Schwab Intelligent Portfolios Premium accounts falls below the $25,000 minimum, you could be unenrolled from Schwab Intelligent Portfolios Premium and lose online access to your plan and planning tools as well as access to a CERTIFIED FINANCIAL PLANNER™ professional.

- When will I be charged the $300 planning fee and the $30/month advisory fee?

-

• The $300 one-time planning fee will be charged upon confirming your first CERTIFIED FINANCIAL PLANNER™ professional meeting.

• A $30 monthly advisory fee will incur 90 days after confirming your first CERTIFIED FINANCIAL PLANNER™ professional meeting, billed quarterly. The monthly fee allows you to continue to have access to a CFP® professional, your digital financial plan, and online planning tools.

- What does a CERTIFIED FINANCIAL PLANNER™ professional do?

- A CFP® professional will meet with you to discuss what you've entered into the planning tool, address any open questions you may have, provide personalized guidance, and create a detailed Action Plan outlining the steps to take in pursuit of your financial goals.

- What does it mean to be a CERTIFIED FINANCIAL PLANNER™ professional?

-

While many may call themselves "financial planners," a CFP® professional has successfully completed the CFP Board's rigorous and ongoing certification requirements. A CFP® professional understands the complexities of financial planning and makes recommendations in your best interest.

- How do I schedule an appointment with a CERTIFIED FINANCIAL PLANNER™ professional?

-

After you log in, you can use the online scheduler to set up a phone or video chat appointment. If you need to reschedule, simply click the "reschedule" link in either the confirmation email or your online dashboard and reschedule your appointment for a more convenient time.

- Will I meet with the same CERTIFIED FINANCIAL PLANNER™ professional every time?

-

While you're able to select the CFP® professional you prefer to meet with from a drop down list, rest assured that every member of the team is a CERTIFIED FINANCIAL PLANNER™ professional. We'll have all of your information at the ready, making it easy to pick up where you left off in your last appointment.

- What should I expect during an appointment with a CERTIFIED FINANCIAL PLANNER™ professional?

-

Whether you meet by phone or video chat, the CFP® professional will review the information you entered in the online planning tool, discuss your personal situation, and create a customized Action Plan for you to follow in pursuit of your goals. Ongoing, a CFP® professional will be available to you for annual check-ins or when your goals or needs change.

The initial meeting lasts between 30 minutes to an hour. Check-ins last about 30 minutes. Prior to the appointment, you'll log in to your Schwab Intelligent Portfolios dashboard. Fifteen minutes prior to the meeting, you'll see a "Join Meeting" button in the Appointment Details section. The button will change to "Meet Now" 5 minutes prior to your start time. You'll then access the virtual meeting room. Since the CFP® professional will contact you by phone, you don't need to connect audio in the video conference session.

- How should I prepare for my appointment with a CERTIFIED FINANCIAL PLANNER™ professional?

-

If applicable, we recommend involving your partner or spouse. Also, have the documents you used to complete the online planning tool on hand for discussion during the appointment. If you connect to your financial accounts automatically, it may still be helpful to have your documents on hand. Review the checklist so you're prepared to make the most of your appointment. You'll need:

• Investment account statements

• Recent paychecks

• Recent tax returns

• Employee retirement account information

• If applicable: Social Security statements

• Annual statement or policy summary on life insurance: type, premium, coverage expiration dates

• Basic estate planning information such as will, trust, etc.

- How frequently will I meet with a CERTIFIED FINANCIAL PLANNER™ professional?

- We recommend meeting with a CFP® professional at least once a year. However, you can schedule an appointment whenever you need financial advice or would like to update your plan.

- Why is Financial Planning important?

- At Charles Schwab, we believe every investor deserves a financial plan as unique as they are. Between saving for retirement, kids' college educations, large purchases, and home improvement—it's easy to feel pulled in many directions. A comprehensive financial plan takes into account your entire financial picture and can act as a map for how you might go about creating and reaching your financial goals. Having a plan can help you be more confident that you are prepared to weather the ups and downs along the way.

- What does Financial Planning include?

- A comprehensive financial plan is like having a roadmap to help you reach your financial goals. It takes into account all aspects of your financial life— income, expenses, investments, college savings, retirement planning, and more. Schwab Intelligent Portfolios Premium is unique in that it combines personal guidance from a CERTIFIED FINANCIAL PLANNER™ professional with our online planning tool.

- How do I start creating my plan?

-

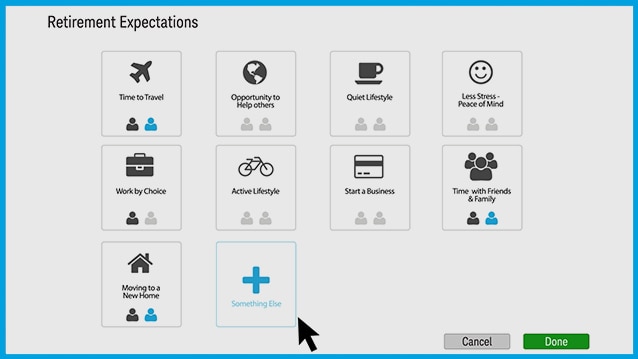

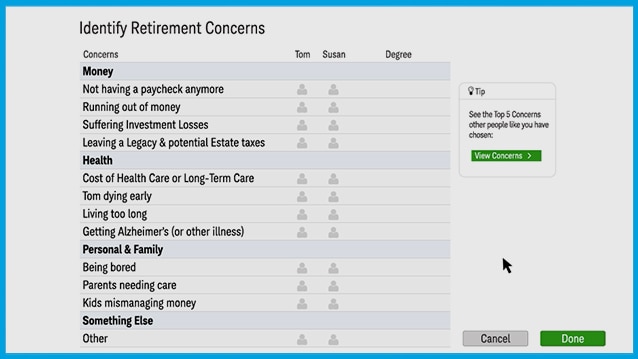

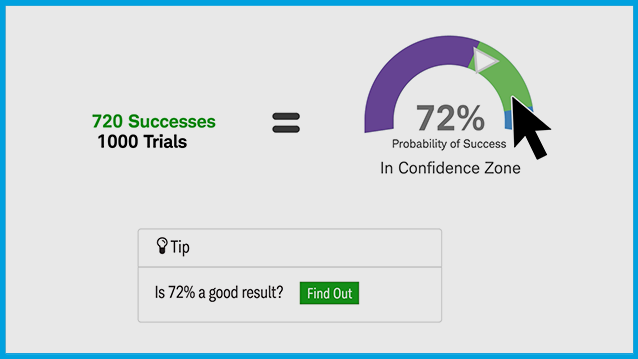

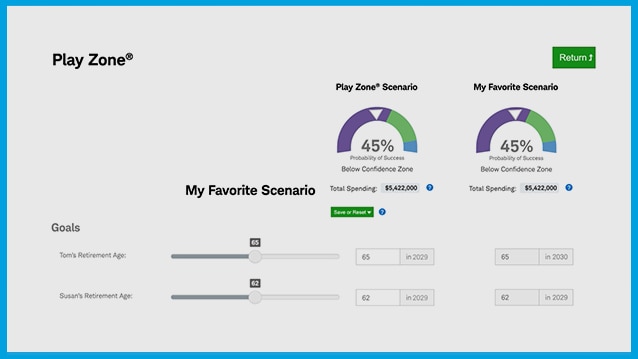

Simply open the secure online planning tool and begin by identifying your goals. As you move through the process, you can play with different scenarios to help you see the potential impacts of your choices. You can do it all at your own pace, saving what you've entered and coming back when you're ready. For the best experience, we recommend that you:

• Involve your partner or spouse, if applicable

• Use a laptop or desktop computer

• Have access to all your financial accounts (or you can connect to your existing accounts automatically)

- How long will it take to complete the interactive online planning tool?

- You can get started with the planning tool in as little as 15 minutes. The more thorough and accurate the information you provide, the better a CERTIFIED FINANCIAL PLANNER™ professional can advise you.

- Can I save my information in the online planning tool along the way?

- Yes, the information you enter in the online planning tool is automatically saved as you go, so you can easily pick up where you left off at any time. Your information will be saved for 60 days from when you start using the online planning tool.

- Is there a way for me to connect to my existing financial accounts automatically?

- Yes, you can easily and securely link to your existing accounts at over 11,000 financial institutions. The types of accounts you can connect to include brokerage accounts, retirement accounts, 529 accounts, annuities, checking and savings accounts, credit card accounts, and loans.

- What's the difference between Schwab Intelligent Portfolios Premium and Schwab Intelligent Portfolios®?

- Schwab Intelligent Portfolios offers strictly algorithm-based portfolio management. Schwab Intelligent Portfolios Premium additionally offers comprehensive financial planning with guidance from a CERTIFIED FINANCIAL PLANNER™ professional and access to online planning tools for a one-time planning fee of $300 and just a $30/month advisory fee after that. There is also a $25,000 minimum investment. Just as if you'd invested on your own, you will pay the operating expenses on the ETFs in your portfolio, which includes Schwab ETFs. We believe cash is a key component of an investment portfolio. Based on your risk profile, a portion of your portfolio is placed in an FDIC-insured deposit at Charles Schwab Bank, SSB. Charles Schwab & Co. Inc. is not an FDIC-insured bank and deposit insurance covers the failure of an insured bank. Charles Schwab & Co., Inc. is a brokerage firm and a member of SIPC, which provides protection for brokerage account assets. Certain conditions must be satisfied for FDIC insurance coverage to apply. Non-deposit products are not insured by the FDIC; are not deposits; and may lose value. Some cash alternatives outside of the program pay a higher yield. See more information below.

- What types of accounts can I open?

-

You can open any of these types of accounts:

•Taxable account types: Individual, Joint Tenant, Tenants in Common, Community Property, Custodial, Revocable Living Trust

•Tax-advantaged account types: Traditional IRA, Roth IRA, Rollover IRA, Inherited IRA, SEP-IRA, SIMPLE IRA

- How is my portfolio built and managed?

- Schwab Intelligent Portfolios uses an advanced algorithm and the professional insight of the Charles Schwab Investment Management, Inc. (CSIM) team. You'll get a diversified portfolio composed of exchange-traded funds (ETFs), all handpicked by CSIM. Portfolios are constructed from about 20 asset classes across stocks, fixed income, real estate, and commodities, as well as an FDIC-insured cash component—so they're truly diversified. Certain conditions must be satisfied for FDIC insurance coverage to apply. After the ETFs are chosen, the experts at CSIM monitor their performance on an ongoing basis.

- What is Charles Schwab Investment Management, Inc.? (CSIM)

- Charles Schwab Investment Management, Inc. ("CSIM"), dba Schwab Asset Management® is a registered investment adviser and an affiliate of Charles Schwab & Co., Inc. ("Schwab"). CSIM dedicates an entire team of experienced analysts to continually researching and evolving CSIM's approach to creating asset allocations designed to improve outcomes for individual investors. CSIM provides portfolio management services for Schwab Intelligent Portfolios.

- What are exchange-traded funds, and why are Schwab Intelligent Portfolios portfolios composed of them?

- An exchange-traded fund (ETF) is a portfolio of securities, such as stocks or bonds, that trades intraday on an exchange. Generally a low-cost way to build a diversified portfolio, an ETF can provide diversified exposure to a particular segment of the market, to a specific industry, or to a particular geographical region.

- What is rebalancing and when does that happen?

- Rebalancing is the act of periodically buying or selling assets to restore your portfolio to its original target allocation range. Schwab Intelligent Portfolios automatically rebalances accounts by using an advanced algorithm that adjusts your account when an asset class shifts above or below its target range. Every portfolio has a target asset allocation—a combination of stocks, bonds, commodities, and cash determined by stated goals, risk tolerance, and time horizon. Over time, contributions, withdrawals, gains, and losses cause a portfolio to stray from the original target and become unbalanced.

- What is tax-loss harvesting?

-

Tax-loss harvesting is a strategy that seeks to postpone capital gains by offsetting them with capital losses. Your portfolio(s) will be monitored for tax-loss harvesting opportunities— examining not only a loss itself, but also your cost basis for tax purposes, as well as the amount of time you've held the position. You must have at least $50,000 in an individual Schwab Intelligent Portfolios account to be eligible for automatic tax-loss harvesting, should you choose to enroll.

Tax‐loss harvesting is available for clients with invested assets of $50,000 or more in their account. Clients must choose to activate this feature. The tax‐loss harvesting feature available with Schwab Intelligent Portfolios Solutions is subject to limitations which are described on the Schwab Intelligent Portfolios Solutions website and mobile application (collectively, the "Website") as well as in the Schwab Intelligent Portfolios Solutions disclosure brochures (the "Brochures"). You should consider whether to activate the tax‐loss harvesting feature based on your particular circumstances and the potential impact tax‐loss harvesting may have on your tax situation. Please read the tax‐loss harvesting disclosures on the Website and in the Brochures before choosing it. Neither the tax‐loss harvesting strategy nor any discussion herein is intended as tax advice, and neither Charles Schwab & Co., Inc. nor its affiliates, including but not limited to Charles Schwab Investment Management, Inc., represents that any particular tax consequences will be obtained. For more information please visit the IRS website at www.irs.gov.

- What is a Cash Sweep?

- The Sweep Program is a feature that allows for the cash allocation in your Schwab Intelligent Portfolios account to earn interest by being "swept" into an FDIC-insured deposit at Charles Schwab Bank, SSB. Charles Schwab & Co. Inc. is not an FDIC-insured bank and deposit insurance covers the failure of an insured bank. Charles Schwab & Co., Inc. is a brokerage firm and a member of SIPC, which provides protection for brokerage account assets. Certain conditions must be satisfied for FDIC insurance coverage to apply. Non-deposit products are not insured by the FDIC; are not deposits; and may lose value. The interest rate on cash balances in the Sweep Program is set on the first business day of each month equal to the seven-day yield (with waivers) for the Schwab Government Money Fund – Sweep Shares (symbol: SWGXX) as determined at the end of the prior month. See Current Interest Rates for more details. You can view the cash allocation on your portfolio dashboard.

- How do I withdraw funds from my Schwab Intelligent Portfolios?

-

You can withdraw cash at any time by logging in to your account and requesting a transfer to another Schwab brokerage or Schwab bank account, or to another financial institution. Funds will be available immediately unless the amount that you request be withdrawn exceeds the cash allocation in your portfolio. If the withdrawal requires the sale of ETFs to provide the requested cash, the availability of the funds will be delayed until the sale transactions have settled (ETFs have a two-day settlement, not including the day of sale). After your withdrawal, your portfolio will rebalance as needed to reach its target asset allocation. If the balance across all your Schwab Intelligent Portfolios Premium accounts falls below the $25,000 minimum, you could lose access to your financial plan and a CERTIFIED FINANCIAL PLANNER™ professional.

- Does Schwab offer a guarantee?

-

We believe every investor deserves to work with a firm they can count on. At Schwab, our commitment to you is backed by a satisfaction guarantee. If for any reason you're not completely satisfied, we'll refund any eligible fee and work with you to make things right. You won't find that kind of promise everywhere. But you will find it here.

**Schwab Satisfaction Guarantee: If you are not completely satisfied for any reason, at your request Charles Schwab & Co., Inc. ("Schwab"), Charles Schwab Bank, SSB ("Schwab Bank"), or another Schwab affiliate, as applicable, will refund any eligible fee related to your concern. Refund requests must be received within 90 days of the date the fee was charged. Two kinds of "Fees" are eligible for this guarantee: (1) "Program Fees" for the Schwab Wealth Advisory ("SWA"), Schwab Managed Portfolios™ ("SMP"), Schwab Intelligent Portfolios Premium® ("SIP Premium"), and Managed Account Connection® ("Connection") investment advisory services sponsored by Schwab (together, the "Participating Services"); and (2) commissions and fees listed in the Charles Schwab Pricing Guide for Individual Investors or the Charles Schwab Bank Pricing Guide.

For more information about Program Fees, please see the disclosure brochure for the Participating Service, made available at enrollment or any time at your request. The Connection service includes only accounts managed by Charles Schwab Investment Management, Inc., an affiliate of Schwab. The guarantee does not cover Program Fees for accounts managed by investment advisors who are not affiliated with Schwab or managed by Schwab-affiliated advisors outside of the SWA, SMP, SIP Premium, and Connection services.

The guarantee is only available to current clients. Refunds will only be applied to the account charged and will be credited within approximately four weeks of a valid request. No other charges or expenses, and no market losses will be refunded. Other restrictions may apply. Schwab reserves the right to change or terminate the guarantee at any time.

- How can I be sure my information will be secure and kept private?

- We take your security and privacy seriously. When you interact with our website, we use a number of safeguards to protect your information. We continuously monitor our systems, and we work with government agencies, law enforcement, and other financial services firms to address potential threats. Our sites also use multilayered protections beyond login name and password before granting access to an account. Learn more about our security and privacy measures.

Don't see the answer

you need? Contact us

Call 855-694-5208