Selecting fixed income investments

Learn how to decide which fixed income investments best fit your needs.

Please Note: Certain conditions must be satisfied for FDIC insurance coverage to apply. Charles Schwab & Co., Inc. is not an FDIC-insured bank and deposit insurance cover the failure of an insured bank. Please visit the Schwab CD OneSource® page for a list of insured financial institutions that offer CDs through Schwab.

Define your fixed income investment goals.

Define your goals

Whether you're looking to save for a near-term expense, add stability to your portfolio, or create a revenue stream, there are many fixed income investment products for you to consider.

- Financial goal

- Fixed income products to consider

-

Financial goalI want to protect my investmentFixed income products to consider

- Short-term CDs (Certificates of Deposit)

- Short-term Treasuries

- Short-term investment-grade municipal or corporate bonds

- Short-term bond funds

-

Financial goalI want to add income and balance to my portfolioFixed income products to consider

- Short- and intermediate-termTreasuries

- Short- and intermediate-term agency bonds

- Short- and intermediate-term international developed-market bonds

- Short- and intermediate-term investment-grade corporate or municipal bonds

- Short-term to intermediate-term bond funds

- Agency mortgage-backed securities

-

Financial goalI want to generate more interest incomeFixed income products to consider

- Long-term Treasury or corporate or municipal bonds

- Emerging market bonds or bond funds

- Preferred securities or preferred securities funds

Select an investment allocation strategy.

Select an investment allocation strategy

Create a mix of fixed income investments that balance your portfolio to help meet your goals. These five sample asset allocation strategies show how fixed income investments can be adjusted in your overall portfolio.

-

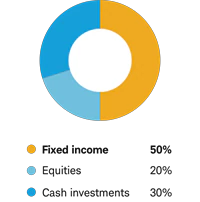

Conservative

For investors who seek current income and stability, and are less concerned about growth.

-

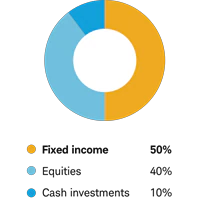

Moderately conservative

For investors who seek current income and stability, with modest potential for increase in the value of their fixed income investments.

-

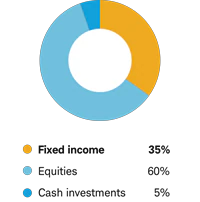

Moderate

For long-term investors who don't need current income and want some growth potential. Likely to have some fluctuations in value, but less volatility than the overall equity market.

-

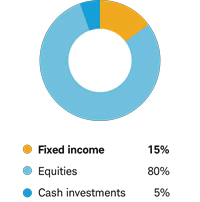

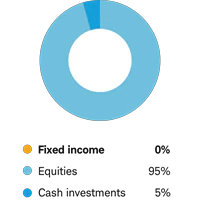

Moderately aggressive

For long-term investors who want good growth potential and don't need current income. Likely to have a fair amount of volatility, but not as much as a portfolio invested exclusively in equities.

-

Aggressive

For long-term investors who want high growth potential and don't need current income. May have substantial year-to-year volatility in value in exchange for potentially high long-term returns.

Want help determining an appropriate fixed income investment allocation for you?

-

Want help determining an appropriate fixed income investment allocation for you?

Use our Interactive Profile Questionnaire to find a suitable investment strategy.

Determine your time frame and the level of risk you're comfortable with.

Maturity timeframe

Traditionally, longer-term bonds produce higher yields but also have higher interest rate risk—the risk that the value of a bond price will fall if interest rates rise. Thus, your time frame may be one factor in determining the amount of interest rate risk you're willing to take on with your fixed income investments.

Maturity timeframe- Low interest rate risk

- Medium interest rate risk

- High interest rate risk

-

Maturity timeframeLow interest rate risk0 - 4 years average maturityMedium interest rate risk4 - 10 years average maturityHigh interest rate risk10+ years average maturity

Credit risk

It's also important to consider credit risk—the chance that the issuer of a bond will not be able to repay its debt obligations. With riskier lenders, the return may be higher, but the odds of an investor losing their principal rise.

Credit risk- Low credit risk

- Medium credit risk

- High credit risk

-

Fixed income productsLow credit riskCDs, Treasuries, agency bonds, agency mortgage-backed securitiesMedium credit riskInvestment-grade corporate or municipal bonds, international developed market bondsHigh credit riskPreferred securities, emerging market debt, high-yield bonds, high-yield municipal bonds, bank loans

Evaluate and get invested.

Whether you're a self-directed investor or prefer professional management, Schwab has account options for you.

Questions? We're ready to help.

-

Call

Call -

Chat

Chat -

Visit

Visit