7 Investing Principles

The basic building blocks of investing.

1. Establish a plan based on your goals.

- Be realistic about your goals.

- Review your plan at least annually.

- Make changes as your life circumstances change.

Planning can help propel investors toward their goals.

The more change we experience in our lives—or in the world—the more we need a plan. Investors who plan for their current and future needs, and who monitor those plans, are more likely to take the steps necessary to achieve their financial goals. Investors with a written financial, investment, wealth, or legacy plan have better saving, investing, and financial habits than those who don't.

-

Source: Schwab Modern Wealth Survey. The online survey was conducted March 4–18, 2024, in partnership with Logica Research among a national sample of Americans aged 21 to 75. Survey sample size was 1000.

Investing involves risk, including loss of principal. The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed. Supporting documentation for any claims or statistical information is available upon request.

The Schwab Center for Financial Research is a division of Charles Schwab & Co., Inc.

See how every Schwab client can get a complimentary plan focused on retirement.

Learn more

2. Start saving and investing today.

- Get started—or if you're already investing, keep doing so.

- Time in the market is key.

- Don't try to time the markets—it's nearly impossible.

One basic principle is to invest early.

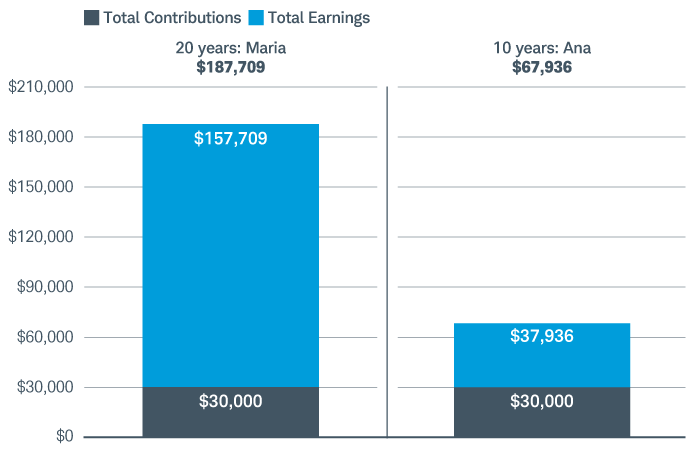

In this example, Maria and Ana each invested $3,000 every year on January 1 for 10 years—regardless of whether the market was up or down. But Maria started 20 years ago, whereas Ana started only 10 years ago. So, although they each invested a total of $30,000, by 2025, Maria had about $120,000 more because she was in the market longer.

-

Source: Schwab Center for Financial Research with data from Morningstar. Invested in a hypothetical portfolio that tracks the S&P 500® index from January 1, 2005 to December 31, 2024 for Maria, and from January 1, 2015 to December 31, 2024 for Ana. The end amount includes capital appreciation and dividends. Dividends are assumed to be reinvested when received. Fees and expenses would lower returns. Ana's average annual rate of return is 13.10%; Maria's is 10.35%. The actual rate of return will fluctuate with market conditions. Past performance is no indication of future results.

Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

Don't try to predict market highs and lows.

The market is volatile by nature, and many investors are tempted to get out of the market when things turn bad. But that doesn't necessarily work out in your favor. For example, if you had invested $100,000 on January 1, 2024, but missed the top 10 trading days, you'd have had $19,903 less by the end of the year than if you'd stayed invested the whole time.

-

Source: Schwab Center for Financial Research with data from Morningstar. The year begins on the first trading day in January and ends on the last trading day of December, and daily total returns were used. Returns assume reinvestment of dividends. Fees and expenses would lower returns. When out of the market, cash is not invested. Market returns are represented by the S&P 500 index, an index of widely traded stocks. Top days are defined as the best performing days of the S&P 500 during 2024. This hypothetical example is only for illustrative purposes. Past performance is no indication of future results.

Take action on these principles with Schwab's investment advice solutions.

Learn more

3. Build a diversified portfolio based on your tolerance for risk.

- Know your time horizon and your ability, capacity, and willingness to take risk.

- Understand that asset classes behave differently and play different roles in your portfolio.

- Don't chase past performance.

Asset classes perform differently.

Asset classes, whether traditional (such as stocks, bonds, and cash) or newer (such as cryptocurrencies and alternatives) have different levels of expected risk, return, and diversification power. Understand each asset class before investing in it.

$100,000 invested at the beginning of 2005 would have had a volatile journey to nearly $720,000 by the end of 2024 if invested in U.S. stocks. If invested in cash equivalent investments or bonds, the investor's ending amount would be lower, but their path would have been smoother. Investing in a moderate allocation portfolio would have combined some of the growth of stocks with lower volatility over the long term.

-

Source: Schwab Center for Financial Research with data from Morningstar. The indexes used are: S&P 500 (large-cap equity), Russell 2000® (small-cap equity), MSCI EAFE® Net of Taxes (international equity), Bloomberg U.S. Aggregate Bond Index (fixed income), and FTSE U.S. 3-Month Treasury Bill Index (cash equivalents). The Moderate Allocation is 35% large-cap equity, 10% small-cap equity, 15% international equity, 35% fixed income, and 5% cash, using the indexes noted. Past performance is no indication of future results. Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly. This hypothetical example is only for illustrative purposes.

It's nearly impossible to predict which asset classes will perform best in a given year.

-

Source: Morningstar Direct and the Schwab Center for Financial Research. Data is from 2015 to 2024. Asset class performance represented by annual total returns for the following indexes: S&P 500 index (U.S. Lg Cap), Russell 2000 Index (U.S. Sm Cap), MSCI EAFE® net of taxes (Int'l Dev), MSCI Emerging Markets IndexSM (EM), S&P United States REIT Index (U.S. REITs), S&P GSCI® (Commodities), Bloomberg U.S. Treasury Inflation-Protection Securities (TIPS) Index, Bloomberg U.S. Aggregate Bond Index (Core Bonds), Bloomberg U.S. High-Yield Very Liquid Index (High Yld Bonds), Bloomberg Global Aggregate Ex-USD TR Index (Int'l Dev Bonds), Bloomberg Emerging Markets USD Bond TR Index (EM Bonds), and FTSE U.S. 3-Month Treasury Bill Index.

The diversified portfolio is a hypothetical portfolio consisting of 18% S&P 500, 10% Russell 2000, 3% S&P U.S. REIT, 12% MSCI EAFE, 8%, MSCI EAFE Small Cap, 8% MSCI EM, 2% S&P Global Ex-U.S. REIT, 1% Bloomberg U.S. Treasury 3-7 Year Index, 1% Bloomberg Agency, 6% Bloomberg Securitized, 2% Bloomberg U.S. Credit, 4% Bloomberg Global Agg Ex-USD, 9% Bloomberg VLI High Yield, 6% Bloomberg EM, 2% S&P GCSI Precious Metals, 1% S&P GSCI Energy, 1% S&P GSCI Industrial Metals, 1% S&P GSCI Agricultural, and 5% Bloomberg Short Treasury 1-3 Month Index. Including fees and expenses in the diversified portfolio would lower returns. The portfolio is rebalanced annually. Returns include reinvestment of dividends, interest, and capital gains. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested in directly. The Return column displays the annualized return from 2015 to 2024 and the Std Dev column displays the standard deviation over the same period. Standard deviation, commonly used as a measurement of risk, is a statistical measure that calculates the degree to which returns have fluctuated over a given time. Past performance is no indication of future results. Diversification and asset allocation strategies do not ensure a profit and do not protect against losses in declining markets.

What is your risk tolerance?

Use the slider to select a level of risk. Then see how a hypothetical portfolio with that risk level performed each year over a 30-year period in the graph.

-

For illustrative purposes only. Not representative of any specific investment or account.

Annualized returns are calculated using data from 1995 through 2024 and include reinvestment of dividends, interest, and capital gains. Stocks are represented by the S&P 500 index, bonds by Bloomberg U.S. Aggregate Bond Index, and cash by the Ibbotson US 30 Day Treasury Bill Index. Indexes are unmanaged, do not incur fees or expenses, and cannot be invested directly. Past performance is not a guarantee of future results.The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decisions.

4. Understand fees and taxes.

- Markets are uncertain; fees are certain.

- Pay attention to net returns.

- Manage taxes to help maximize returns.

Fees can eat away at your returns.

$3,000 is invested in a hypothetical portfolio that tracks the S&P 500 index every year for 10 years, then nothing is invested for the next 10 years. Over 20 years, lowering fees by three-quarters of a percentage point would save Maria roughly $21,000 and Ana roughly $3,200.

-

Source: Schwab Center for Financial Research with data from Morningstar. The hypothetical investor invests $3,000 on the first day of January of every year for 10 years. Returns are assessed a fee at year-end. The hypothetical portfolio tracks the S&P 500 index from January 1, 2005 to December 31, 2024, with $3,000 in annual contributions invested for just the first 10 years. In scenarios involving fees, those fees are paid annually each year. Chart does not take into account the effects of any possible taxes.

Indexes are unmanaged, do not incur management fees, costs, and expenses, and cannot be invested in directly.

Try to minimize taxes.

$3,000 is invested in a hypothetical portfolio that tracks the S&P 500 index every year for 10 years, then nothing is invested for the next 10 years. Placing investments in a tax-deferred account can result in higher ending wealth after 20 years.

-

Source: Schwab Center for Financial Research with data from Morningstar. In the tax-deferred hypothetical scenario, $3,000 is invested in a hypothetical portfolio that tracks the S&P 500 index every year for 10 years, then nothing is invested for the next 10 years. The account earns capital appreciation and dividends. Dividends are assumed to be reinvested when received. Maria makes a lump-sum withdrawal in year 20, when she is in the 24% marginal tax bracket. In the taxable scenario, Maria is in the 24% marginal tax bracket and after taxes invests $2,250 in a hypothetical portfolio that tracks the S&P 500 index every year for 10 years. She invests nothing for the next 10 years, leaving her money fully invested. The account earns dividends, which are taxed at 15%, and recognizes capital gains every five years during portfolio rebalancing. Capital gains are taxed at 15% with net proceeds reinvested. Performance is based on historical returns of the S&P 500 from January 1, 2005 to December 31, 2024. This information does not constitute and is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. Where specific advice is necessary or appropriate, Schwab recommends consultation with a qualified tax advisor, CPA, financial planner, or investment manager.

5. Build in methods to deal with significant losses.

- Modest temporary losses are tolerable for most investors, but recovery from significant losses can take years.

- Consider cash equivalent investments and bonds for diversification and to lower volatility in part of the portfolio.

- While advanced orders and complex products like options and futures are ways to manage risk, the average long-term investor is more likely to use traditional portfolio techniques like dollar-cost averaging and rebalancing.

Steep declines are hard to bounce back from.

Down markets are unpredictable and can have a dramatic impact on personal plans like retirement. In several recent downturns, an all-stock portfolio tended to take longer than a diversified portfolio to return to its prior peak.

-

Source: Schwab Center for Financial Research with data from Morningstar. Stocks are represented by total annual returns of the S&P 500 index, and bonds are represented by total annual returns of the Bloomberg U.S. Aggregate Bond Index. The 60/40 portfolio is a hypothetical portfolio consisting of 60% S&P 500 index stocks and 40% Bloomberg U.S. Aggregate Bond Index bonds. The portfolio is rebalanced annually. Returns include reinvestment of dividends, interest, and capital gains. Fees and expenses would lower returns. Diversification strategies do not ensure a profit and do not protect against losses in declining markets. Past performance is no indication of future results.

Defensive asset classes have performed better when stocks decline.

During two recent market downturns, defensive assets had positive returns—significantly outperforming U.S. stocks.

-

Source: Schwab Center for Financial Research with data provided by Morningstar. The three periods were selected to show how defensive asset classes performed when U.S. stocks decrease by more than 20% annually in the 20-year time period from 2002 to 2023. Indexes representing each asset class are S&P 500 TR Index (US stocks), FTSE U.S. 3-Month Treasury Bill Index, Bloomberg US Treasury 3-7 Year TR Index (treasuries), S&P GSCI Precious Metal TR Index (precious metals), and Bloomberg Global Aggregate Ex-US Bond TR Hedged Index (international bonds). Returns assume reinvestment of dividends and interest. Fees and expenses would lower returns. International investing may involve greater risk than U.S. investments due to currency fluctuations, unforeseen political and economic events, and legal and regulatory structures in foreign countries. Such circumstances can potentially result in loss of principal. Past performance is no indication of future results. Indexes are unmanaged, do not incur fees and expenses, and cannot be invested in directly. This chart is for illustrative purposes only.

6. Rebalance regularly.

- Be disciplined about your tolerance for risk.

- Stay engaged with your investments.

- Understand that asset classes behave differently.

Regular rebalancing helps keep your portfolio aligned with your risk tolerance.

A portfolio began with a 50/50 allocation to stocks and bonds and was never rebalanced. Over the next 12 years, the portfolio drifted to an allocation that was 78% stocks and only 22% bonds—leaving it positioned for larger losses when the market turned in 2022 than it would have experienced if it had been rebalanced regularly.

-

Source: Schwab Center for Financial Research with data from Morningstar. The hypothetical portfolio above is composed of 50% stocks and 50% bonds on December 31, 2009 and is not rebalanced through December 31, 2021. Asset class allocations are derived from a weighted average of the total monthly returns of indexes representing each asset class. The indexes representing the asset classes are the S&P 500 index (stocks) and the Bloomberg U.S. Aggregate Bond Index (bonds). Returns assume reinvestment of dividends and interest. Indexes are unmanaged, do not incur fees and expenses, and cannot be invested in directly. Rebalancing may cause investors to incur transaction costs and, when rebalancing a non-retirement account, taxable events may be created that may increase your tax liability. Rebalancing a portfolio cannot ensure a profit or protect against a loss in any given market environment.

7. Ignore the noise.

- Daily financial news stories may be more relevant to short-term traders than long-term investors.

- Markets fluctuate up and down.

- Stay focused on your plan.

Progress toward your goal is more important than short-term performance.

The market has experienced numerous setbacks over the decades—but the optimist who invested early and stuck to their plan would have been rewarded over the long term.

-

Source: Schwab Center for Financial Research with data from Morningstar. The chart illustrates the growth of $5,000 invested in the S&P 500 Index from January 1, 1970 to December 31, 2024. Past performance is no indication of future results. Indexes are unmanaged, do not incur fees and expenses, and cannot be invested in directly. This hypothetical example is only for illustrative purposes.

#1 Broker Overall ranking by Investor's Business Daily.

CTA

Schwab can help you take action on these principles.

Questions? We're ready to help.

-

Call

Call -

Chat

Chat -

Visit

Visit